Wyndham Rewards Program allows you to redeem for free night at any of their hotels, homes and condo worldwide for just 15,000 points with their "Go Free Reward". This enables you to get a great redemption value when you redeem your free night at high end Wyndham Hotel or Resort, but what if you are looking for low to mid tier redemption? Wyndham does allow you to use 3,000 points + Cash for redemption using their "Go Fast Reward". The bad news is that not all hotels have "Go Fast Reward" available. You can also top up your account by purchasing up to maximum of 10,000 points per year at the rate of $13 per 1,000 points. The bad news is that Wyndham Reward Points expire after 18 months unless you have any earning, redeeming or transfer activity. You can easily get pass this by either donating as low as 50 Wyndham Reward Points, or by earning points doing survey with their partner "Opinion Rewards Panel". Although you can get past this they have another layer of hard point expiration where the points expire 4 years after they are earn regardless of your activity with Wyndham Rewards. So, what happens when your points are reaching the 4 year hard expiration limit? One of the option which use to exist earlier was to redeem Wyndham Reward points for magazines but that option is no longer available with Wyndham Rewards. The other option is to redeem for gift card, but the gift card redemption starts at 7,500 points for $25 in value (Except the Restaurant.com gift card which you can get for 2,200 points and a worst value to begin with). Here is the good news though. Wyndham Hotels acquired La Quinta brand of hotels in 2018 and they allow 1:1 transfer of points between Wyndham Rewards and La Quinta Rewards. Although you can transfer in the increments of 1,000 points with a maximum of 24,000 points in single transaction, this transfer allows to move out the points which have 4 years hard expiration with Wyndham Rewards. La Quinta Returns allows you to use these points for hotel redemption with reward night starting at just 6,000 points only or you can redeem them for magazine subscription starting at just 300 points. Alternatively one of the best option would be to transfer these points back to Wyndham Rewards and they should get new expiration date! Do note that Wyndham Rewards is known to be notorious for changing the terms overnight and might take away or devalue this option at any time. So, hopefully the above technique (while it lasts) will allow you to get past the 4 year hard expiration limit that Wyndham Rewards has on its points. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.

0 Comments

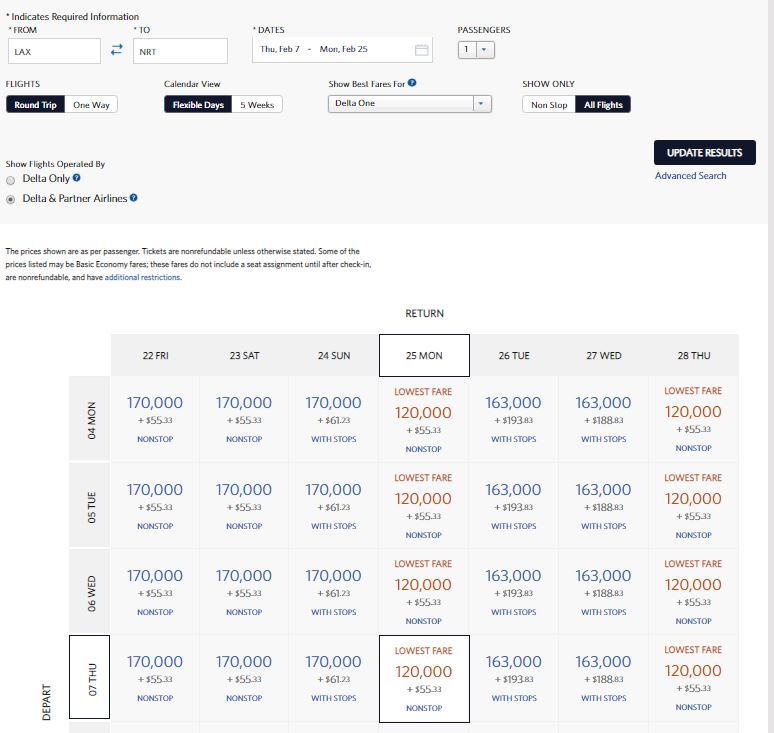

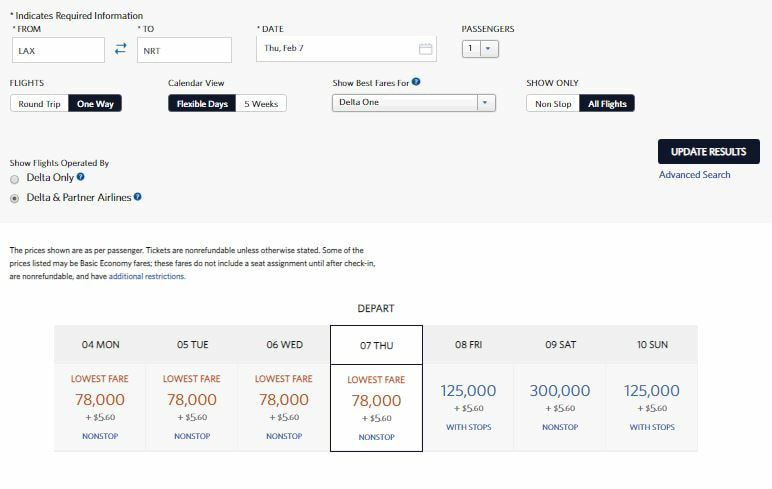

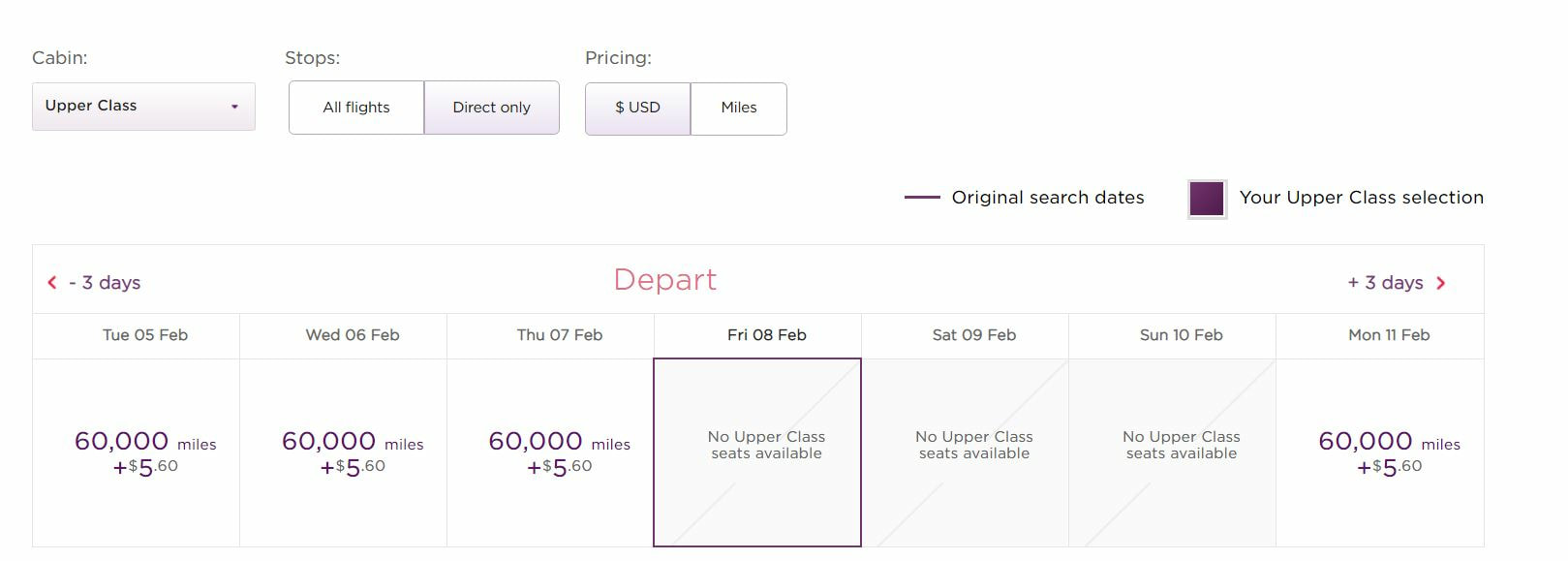

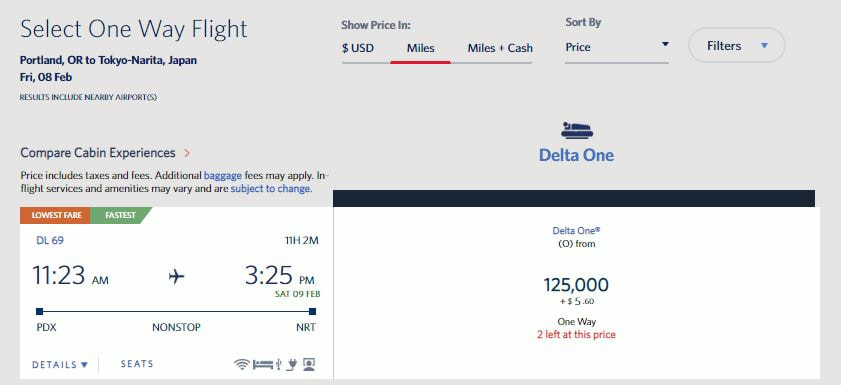

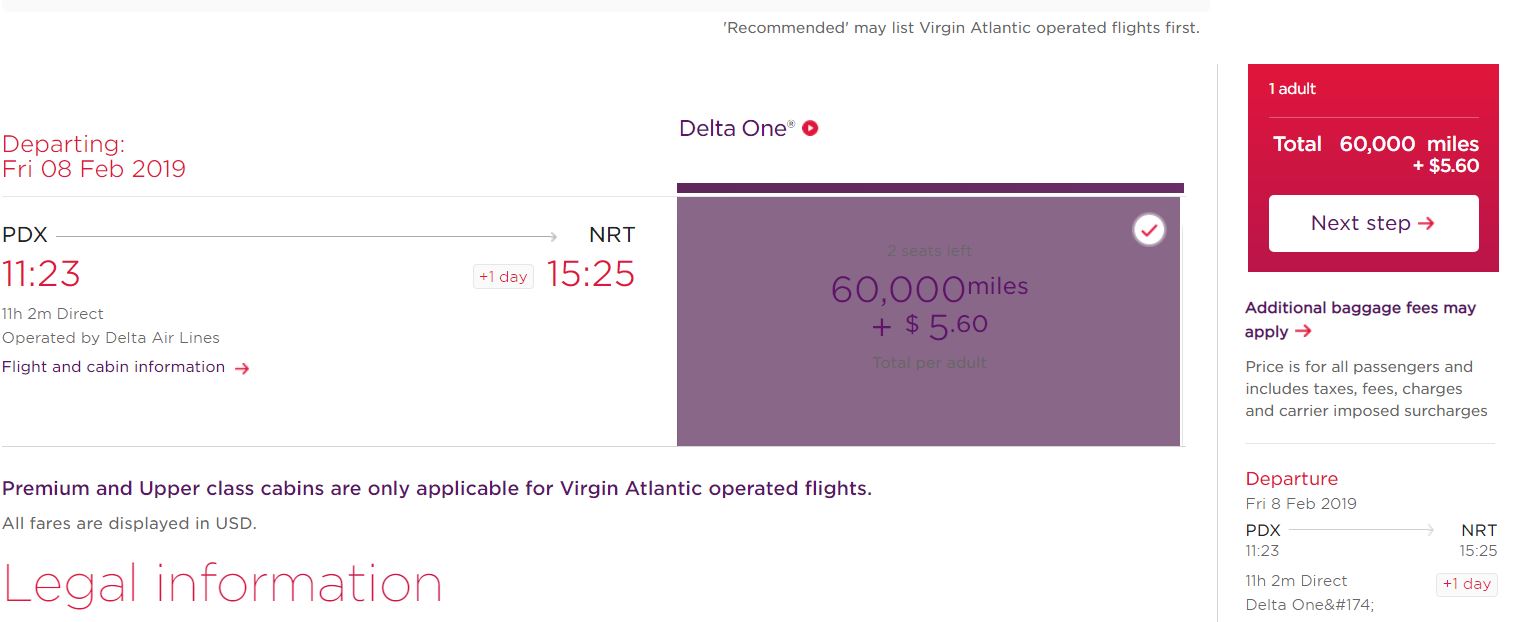

While we all like to collect miles and points to get great redemption or travel at discounted rate, what should we consider the real value in terms of time and effort? The traditional way of collecting miles/points is through airline travel and hotel stays but due to deluge of credit card's which earn miles or points (flexible currency) and have various partners where you can transfer your earned miles/points, it is important to understand the difference between the real and the perceived value. Let's get this straight with few popular credit card examples. Chase Sapphire Reserve card enables points to be redeemed for travel at fix value of 50% more when you redeem through their travel portal. So, each Ultimate Reward Point can be redeemed for real value of 1.5 cent/$ but "only" when redeeming for travel through their travel portal. The annual fee for this card is $450 although you get $300 in travel credits each year. Amex Platinum for Schwab Card allows you to redeem your American Express Membership Reward Points for "cash" at real value of 1.25 cent/$. The annual fee for this card is $550 although you get $200 airline travel incidental (in your pre-selected choice of airline), Total of $180 in Uber credits (distributed over 12 months) and $100 in credits on Saks purchase ($50 each every 6 months). U.S. Bank Altitude Reserve card is similar to Chase Sapphire Reserve where you get fix value of 50% more when redeemed for travel through their travel portal but it does have an option of redeeming for travel directly through airlines, hotel, car rental companies using their real time reward option and get a redemption value of 1.5 cent/$ for each point. The annual fee for this card is $400 although you get $325 in travel credits each year. As you can see from above that although the fixed value of redemption for Chase Sapphire Reserve and U.S. Bank Altitude Reserve looks same the perceived value is different. At 1.25 cent/$ the Amex Platinum for Schwab might look weaker but do note this is hard "cash" redemption. So just looking at redemption value is not enough. All the above credit cards have different annual fees and provide different benefits. When you consider that into account the above real redemption rates becomes perceived value. This is because each person would have different valuation of those benefits based on the usage of the card and its benefits. So, always consider the total benefits of the card before you decide which of the card would be a long term keeper for you. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  We know all miles are not created equal and each mileage currency have some unique features. Virgin Atlantic is one such program which shines in certain areas where Delta Airlines might want to give you some hard time. Delta Airlines publish flash deals for using your miles to book tickets at a discount mileage, but some of these deals go unadvertised or last longer than what Delta Airlines make you believe. Since Delta no longer publishes a award chart you might not know if the price displayed is the actual price or a "flash deal" price. Also most of these flash deals are for round trip and so one-way trip will not necessary be half the miles of round trip ticket. Also Delta Airlines is known to add dynamic mileage pricing component and thus the price might be higher than what you should actually pay. Here is an example itinerary for Los Angeles (LAX), USA to Narita (NRT) / Haneda (HND), Japan in Delta One Suite. As you can see the round trip price is 120,000 Delta Skymiles for few dates but if you want to book just one way that price is 78,000 Delta Skymiles instead of half price of 60,000 miles. Here is where Virgin Atlantic miles would come handy. Virgin Atlantic is a Delta Airline partner and as of recent pass has started displaying award availability for Delta Airlines on its Virgin Atlantic website. The good news is Virgin Atlantic has access to same level of inventory as what Delta Airlines has and it does not add the dynamic pricing what Delta does. So, if you wanted to book just one-way ticket it would cost 60,000 Virgin Atlantic miles for the same award from Los Angeles (LAX) to Narita (NRT) / Haneda (HND) above. Let's check another example where Delta applies Dynamic pricing. Here we are looking to fly from Delta non-stop flight from Portland (PDX) to Narita (NRT). Delta Airlines want to charge 125,000 miles for the below itinerary. Interestingly Virgin Atlantic still wants 60,000 miles only! The other great thing about Virgin Atlantic miles is that they routinely have 30% transfer bonus when you want to transfer your American Express points to Virgin Atlantic miles so you end up getting better value than with Delta Skymiles.

So what is the downside of using Virgin Atlantic miles? Virgin Atlantic charges mileage cost based on segments, so adding segments would add up the price for the mileage redemption. Also if you enter source and destination which does not have direct route then Virgin Atlantic does not show any availability. But with all that quirks you get a great redemption value and yes, do not forget that Virgin Atlantic charges a reasonable change / cancellation fee of only $50! Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  Happy New Year to all the folks! It is a start of new year which means if you have credit cards which gives airline incidental credit on calendar year are available again to take advantage of. American Express Issued credit cards such as American Express Gold Card which provide incidental credits reset based on calendar year and are available for New Year from 01/01/2019. Also specifically for American Express, you do need to select the preferred airline and you get incidental reimbursement for only that airline. Also not all credit card's give credit based on calendar year. Also some of the airline e-gift cards or award ticket taxes and fees might trigger the incidental credit. So do check this flyertalk thread for latest data points if you are looking to purchase gift cards. Below are the credit cards which provides airline incidental credit based on calendar year (Do note the list might not be complete).

There are other cards such as Chase Sapphire Reserve, U.S. Bank Altitude Reserve, Citi Prestige which provides credit for any charge made directly with airlines and other travel categories as defined by their terms and are per "card membership year". Since these are not limited to incidentals you can use them for airfare as well as incidentals. So, get going and redeem these incidental credits before your annual fees come due. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website. |

AuthorI love traveling / backpacking. This blog focuses on below 3 aspects of travel: This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

December 2020

Categories

All

|

RSS Feed

RSS Feed