There are so many credit cards available with good offers that at times it becomes confusing on which credit card to consider. This article will list the best combo (publicly available offers) as of current date that can help you reach to your next award flight. For the sake of brevity we will list only the "bonus miles"! American Airlines 70k miles bonus combo: You can apply for 2 personal credit cards from Citi within 90 days period. That means you can apply for both the cards below using "two browser trick". The trick is to apply for both the cards at the "same time" so that you are considered as first time card holder for both of them and get approved for both with aggregate 70k miles. There are other higher miles offer (not public) available not listed here.

United Airlines 65k to 70k miles bonus combo: You can apply for United Explorer card (25k to 30k miles) + Chase Sapphire Preferred card (40k miles) to get 65k bonus miles (plus 5k miles for adding authorized user). Since both United Explorer Card and Chase Sapphire preferred card are issued by chase it is best advisable to do these two applications more than 90 days apart.

Hawaiian Airlines 70k miles bonus combo: You can apply for 2 Hawaiian airline credit card one each from "Bank of America" and "Bank of Hawaii". This will net you 70k miles which are good enough for return flight to Hawaii!! Make sure you apply for both the cards the same day to avoid any issues of not getting approved.

Above are only few example's which could help you secure you next international inexpensive trip. You could potentially also transfer points/miles from AMEX premier rewards gold or AMEX Starwood Preferred Guest card to add to the total to get higher/better class of travel!!

0 Comments

If you are applying for credit card on regular basis once in a while you will receive the "application on hold" or "denied" reply. Most often than not its just a "call" to the reconsideration department which can help you get that credit card application approved. So, it is important to know that the initial denial does not necessarily mean a denial and you could potentially convert that into approval. The important thing to note here is that application approval depends on multiple factors, few of the most common are listed below: 1. What is your credit worthiness? Your income, assets and available revolving credit determines this. 2. How often are you asking for the "new credit" from the given credit card issuer company? Different credit card issuers have their own criteria in restricting how often they approve you for a new credit card. 3. How good is your credit history? Any score of above 700 for TransUnion, Experian or Equifax is generally considered to be a good score. 4. How long is your credit history? The longer the credit history you have the better off you are. 5. How is your past usage of any earlier issued card by the same credit card issuer? If you have few credit cards issued by the same issuer earlier but you do not seem to be using them very often they do not consider you as a good customer for them. 6. Are you applying for the same card which you had cancelled in the past? Some credit card issuer would deem this bad while others might consider this perfectly fine as your needs could change over the period of time. 7. Do you make your payments on time? The credit card on which you have interest and late payment charges like it, but a new credit card issuer would be less than happy on inducting a new customer who do not pay the dues on time and see the individual as being a high risk for their bank. 8. What is the outstanding balance you maintain with different credit card companies? This could either work in your favor or against depending on the ratio of what's your worth and and what is your outstanding balance. Credit card issuer like to deal with individuals who are not going to default. Above are the most frequent concerns that credit card issuer has, thus it will help you to your advantage if you know the reasons why you are looking for getting that specific credit card. Most credit card company do not want you as a customer if they understand you are doing it just for that elusive sign-up bonus. Below are some suggestions that will help you turn your "so called denial" into approval: 1. Always be polite to the person you are speaking with. Remember you are looking to turn the denial into approval and so being polite helps your cause. Nobody likes a grumpy or angry person. 2. Know the facts before you start your conversation. This could be your credit score's with different credit bureau or your credit utilization from the specific credit card issuer. 3. Understand the features of the credit card which you are looking to get. Knowing the reason's why this is the card you need that goes beyond the sign-on bonus will help you get the card approved. 4. Understand the concern of the credit card issuer and than mitigate it accordingly.

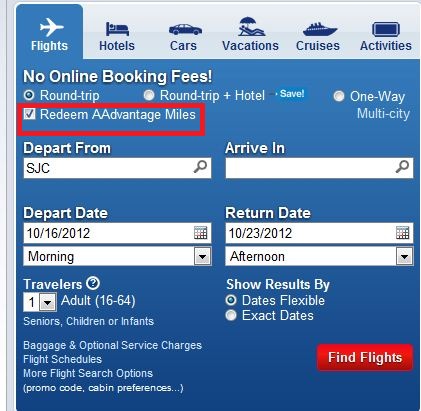

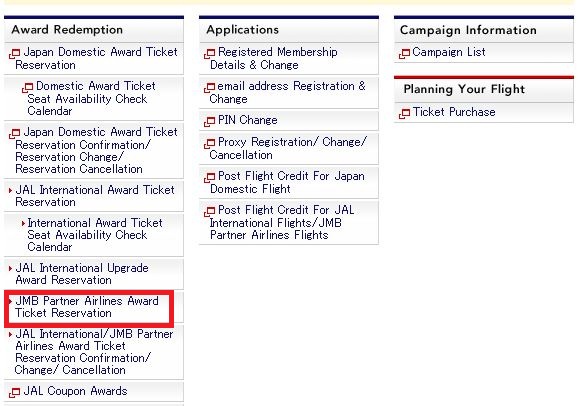

Just make sure that you address their concern in a right way and you will come out winner in your credit card "approval". Resources: Listed below are the phone numbers for the application status & credit card reconsideration department if you hit that denial and want to convert it to an approval!! Chase Bank -- 888-609-7805, 888-871-4649 Citi Bank -- 800-765-9795, 800-645-7240 American Express -- 877-399-3083 Barclay's Bank -- 866-369-1283 Bank of America -- 866-458-8805 Booking an award ticket is another complex area which is rewarding if you understand how to go about doing it. There are several things you could do to find that availability of desired award. Below are some steps you could take before you call the airlines customer desk to inquire about the award availability: 1. Check the airlines website for which you have miles to see if your desired award is bookable online. For e.g. if you have miles on American Airlines (AA) you can first check the award availability on AA. American Airlines does not provide award search for all its partners. As of now it provides award seach for American Airlines, Alaska Airlines, British Airways, Hawaiian Airlines and Qantas. Make sure you have "ticked" "Redeem AAdvantage Miles" box before you begin your search. 2. Determine which alliance your airline belongs to? American Airlines belong to One World Alliance so it would help you determine what all airlines you can possibly fly on? The complete member list can be found here. 3. Determine which airlines fly to your desired destination. This would help you short list tools which you could use for award availability search. Below listed are some free option's for checking award availability:

4. If any of the above does not help you can check out several non airline tools available. Some of them are free with limited features while better options are available with paid subscriptions. Check the below list for these tools:

When it comes to frequent flyer program there are ton of them available. That said the way to get that free flight award faster requires two steps: 1. To identify which frequent flyer program best meets your needs and collect miles on them. 2. To know techniques which can help collecting miles faster so that you can redeem your award quicker. The answer to (1.) lies in two things:

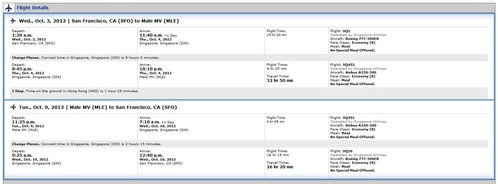

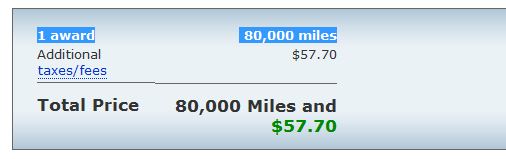

Once you identify the FF program based on above two parameters the next question (2.) is to find the techniques to collect the miles faster. I have written a generic answer on Ways to Accumulate Miles & Points, but this post will go in more details for specific examples. Let's start with an example: You are in US wishing to visit Male in Maldives for that dream trip. Step1: The best bet to get there could be either Via Singapore or Doha. Since you are in US it would be hard to collect miles for either one of those, but you have Star Alliance to your rescue here. Since US Airways and United Airlines both are member of this alliance you can essentially collect miles on any one of them to get to Male. Step2: Once you know that US Airways or United Airlines can get you there, the next question is to search how many miles? I did a random search on united.com and below are the results for flights from San Francisco (SFO) to Male (MLE) and the cost in miles. The total price is 80k miles and $57.7. Just to give a perspective I have also shown the cost in actual $$. Step3:

The next step is how to get those miles? There are more than 1 ways to get there and I will highlight one of them below: Credit Card Churn: As you would have known by now the easiest way to get the miles/points for that free flight is taking credit card. Since we need 80k miles below are the cards you can take:

United partners earning:

This was just a glimpse on what is possible. You could earn potentially miles by renting a car, staying in a hotel or filling up the gas! There are tons of free ways of earning miles as well like enrolling for MyPoints (500 miles) or Buying from Gilt (1500 miles after $50 spend), E-miles (250 e-miles) and E-rewards (250 miles only by invitation). For complete list of United Mileage earning partners check here. Hopefully this will help to piece that trip together! Most of the airlines in US have a co-branded card between themselves and the merchant bank. But there are few credit cards which earn points that can be converted to miles of number of airlines. These cards have advantage of filling out the void of few thousand miles required in specific airline program as well as help in accumulating enough points which can be converted to miles for a reward travel. Lets explore these cards further:

1. American Express Premier Rewards Gold Card: This is one of the go-to card for earning points which can be converted to lot of partner programs, most of them at 1:1 ratio. This card has following features:

The best part of this card is the redemption options available. You can redeem your points into miles for following airlines at the time of this writing:

There are other airlines as partners but for them you can redeem the points only for specific tickets. You can also redeem for various hotel partners but that's not the focus of this article. The complete partner list can be found by going here and selecting "Use Points -> Airlines" 2. Chase Sapphire Preferred: This is one of the favorite personal credit card for lot of people simply because of the ability to earn bonus points on purchases through its "Ultimate Rewards Mall". This card has lot fewer airline partners compared to American Express Premier Rewards card and it transfers the points at 1:1 ratio as well. United and Korean airlines offer great redemption value. This card also has some great features as listed below:

The airline partners are listed below:

3. Starwood Preferred Guest: The value of this credit card lies in points+cash redemption in its brand hotels as well as 1:1.25 points to miles transfer ratio to most of its partner airlines. So for every transfer of 20k points you end up getting 25k miles. Also the long list of partner airlines makes this credit card a good to keep. Below are the features of this card:

The amazing airlines partners list can be found here although few of them are listed below

Note: I do not earn any referral credit from the links above. Also I advise to look for best available offer before applying for the credit cards. |

AuthorI love traveling / backpacking. This blog focuses on below 3 aspects of travel: This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

December 2020

Categories

All

|

RSS Feed

RSS Feed