One of the best card's for extended warranty is Citi. While American Express extended warranty claim is much easier to get approved, AMEX only provides up to 1 year of extended warranty where-as Citi provides up to 24 months of extended warranty. Citi's extended warranty adds 24 months to any original manufacturer warranty or purchased extended warranty from vendor/service provider with maximum vendor/service provider of 5 years. So effectively you can get total of 7 years of extended warranty. The best part is you can get this extended warranty with No annual fee Citi Reward+ credit card. Below are some of the baseline terms. For complete benefits guide you can look up "card benefits" section after login in to your citi online account:

So, let's say for example you buy a cooking range from Home Depot and you purchased extended warranty of 5 years. You will get additional 24 months of coverage extending your warranty to total of 7 years! If you do not want to pay for the extended warranty from Home Depot than you would still have 1 year of manufacturer warranty (usually) and additional 24 months of extended warranty from Citi. (Note: You need to have some manufacturer warranty provided or else Citi's extended warranty does not apply!) You also get reimbursed only for the amount paid with Citi credit card/Thank You points. so ensure that you put full purchase charge on Citi card to get the full benefit. One important thing to check is that even within Citi the extended warranty benefit is not available across all credit card's. For e.g. as of this writing this benefit is not available with Citi Double Cash Card . So do check the benefits of the card before using it for purchase. You can find all the Citi credit card's here. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.

0 Comments

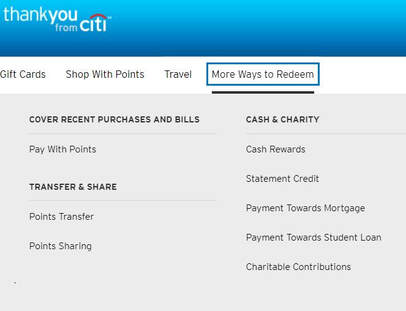

With most of the folks not looking to travel in next few months and uncertainty around travel some of us would be thinking of how to best preserve cash. Most of the flexible credit card points program in the U.S.A such as Chase Ultimate Rewards, Citi ThankYou points allows one to cash out the points for statement credit or cash in checking/savings account. If you have a big stash of these flexible points and no near term travel plan it may be prudent to cash them out. While Chase Ultimate Rewards makes it easy and gives a value of 1:1 (Every 1,000 points can be redeemed for $10 in cash) Citi ThankYou points gives a real bad value of 1:0.5 (Every 1,000 points can be redeemed for $5 in cash). How to maximize cash out of Citi ThankYou points? Citi ThankYou points allows few ways of cashing out the points.

Alternative option of gift card!! You can redeem Citi ThankYou points for gift cards at 1:1 ratio. While not as good as cold hard cash, you could still redeem for plethora of merchants such as Target, Lowe's , Home Depot, Best Buy etc. This would give flexibility of getting close to 1:1 value which otherwise you would not get. You can also sell this gift card at some of the online re-sellers and still get `~90% of the value of gift card as cash getting a redemption ratio of 1:0.9 (1000 points for a value of $9) which is better than 1:0.5. Getting a Citi Rewards+ Card for Better Redemption value:

Citi has a no annual fee Citi Rewards+ Card which gives 10% back in points for any redemption of Citi ThankYou points (Maximum of 10,000 points back per year). If you have this card and redeem for gift card than you can potentially get close to ~1:1 ratio as you would receive 10% back in points. So, do remember alternate option as they might be better of than taking a direct "cash reward" or "statement credit" at reduced value. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  Citi Prestige is the high end travel card from Citi with host of benefits and carry an hefty $450 annual fees. Although some of the benefits are on average side they are few outstanding one's and "Free Roadside Assistance" is one of them. Here is the link to the benefits guide for Citi Prestige credit card. American Express provides several great features in it's version of "Free Roadside Assistance" on the American Express Gold and Platinum cards, but there are few features where Citi Prestige card outshines American Express cards. Below are these key features:

How it Works: Call "1-866-506-5222" when you need roadside assistance and a representative with direct help towards you. Be mindful of certain exclusions such as RV, trailers etc which are not covered by this service. So next time you hit the road do carry your Citi Prestige Card (if you hold that card), and remember to use its roadside assistance service when in need as the coverage provided is hard to beat. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  You can get free $10 in amazon credit if you have any Eligible Citi credit card by making it default payment for Amazon one click settings. Here is the link to the offer. This promo has been around for a while but if you have not taken advantage of it then you can register your Citi Credit Card on amazon.com for this promotion. The promotion is valid till Aug 15, 2017. If for some reason the offer page says that you are not eligible for the promotion you can remove all the Citi Credit card from your Amazon.com profile and try registering through the link after 24-48 hours of removing the Citi Credit card. Below are terms from the offer page for your convenience: TERMS AND CONDITIONS

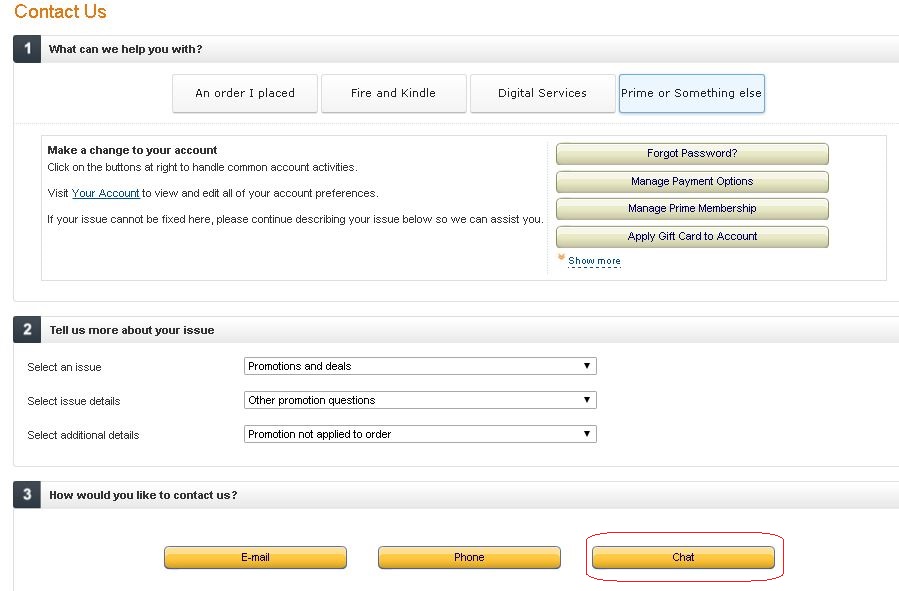

Hat-tip: [Doctor Of Credit]  There are few great amazon promotions going on where you can score $10 off on $10 or $15 off on $50 purchase from Amazon for goods sold and shipped by Amazon. Here are the promo details: $10 off $10 or more purchase using pay with Discover Cashback Bonus The details of the deal can be found on this slickdeals thread, but the idea is you need to link your Discover Card to your Amazon account. Add $10 or more items which are sold and shipped by Amazon and select payment method to be Discover Credit Card with payment of at-least 1 cent from your Discover Cashback Bonus. In the promo code box enter the code "SWP07DFS10" on the check-out page. You should see $10 being taken off your purchase. Here is the link to the terms of this promo. $15 off $50 or more purchase using Amex Membership Reward Points The details of the deal can be found on this slickdeals thread, but the idea is you need to link your AMEX Membership points earning credit card to your Amazon account. Add $50 or more items which are sold and shipped by Amazon and select payment method to be American Express (AMEX) Credit Card with payment of at-least 1 cent from your Membership Reward Points. In the promo code box enter the code "SWP07AXP15" on the check-out page. You should see $15 being taken off your purchase. Here is the trick to make above work! Although the above promotions are "targeted" and may not work for your account, the trick to make both the above deals to work is chat with Amazon customer care which you have stuff added in your Amazon cart. Here is the link to that page. Select "1. Prime or Something else" --> "2. Promotion & Deals" --> "3. Chat" option and speak with the representative that you have this promotion but not able to apply the code and you will hopefully get $10/ $15 taken off your order or $10/ $15 credit for your future order. $10 off $10 Citi one-click setting change promotion

The reason I listed this in the end is because there is a way by which you can potentially make this work and get $10 off $10 or more purchase by making Citi Credit Card as your preferred "One-click setting credit card". This promo will appear automatically if you login on the "app" from your android device and you can just register for it. The other way to make it work is by using the steps on this slickdeals thread. There is no promo code required and the promotion automatically gets applied at the checkout when you select the Citi credit card as the form of payment. So, enjoy free credits from Discover, Citi and American Express (AMEX). |

AuthorI love traveling / backpacking. This blog focuses on below 3 aspects of travel: This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

December 2020

Categories

All

|

RSS Feed

RSS Feed