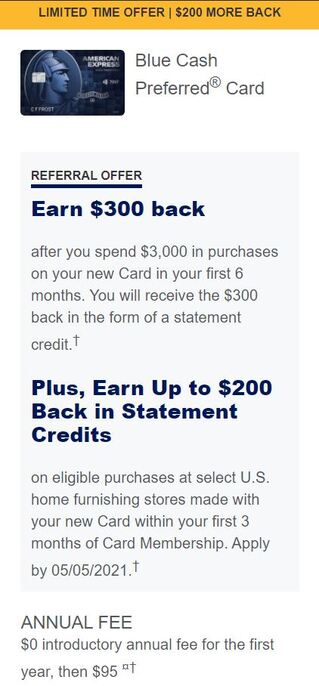

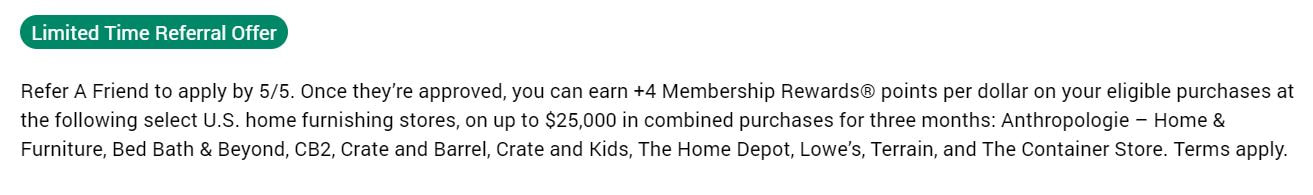

American Express has been on a tear with awesome credit card offers of late and to top it the current offers through referral where you get up to $200 additional statement credit for purchases at "select home furnishing stores" is just icing on the cake. The great part of the offer is that the $200 additional statement credit is available on many more credit cards which makes the sign up offer on those cards awesome, such the below offer on Blue Cash Preferred Card. Also the person referring using their personal Membership Points earning card would earn additional 4 points per $ spent up to spend of $25k for next 3 months in the same "select home furnishing stores" in addition to the fixed referral bonus after a successful referral is made. But this is Amex and you got to be careful on what Amex defines as "eligible purchases". As of late Amex has up their ante on clawbacks and you do not want it to happen to you. So below are the list of things which Amex considers ripe for clawbacks and it is better to avoid them then be sorry:

Even, the additional $200 statement credit which Amex is advertising for referral offer might be ripe for clawback if used in the way above and its better to be cautious then sorry! So go ahead for this awesome referral offers while it lasts but tread with caution as you are dealing with Amex. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.

0 Comments

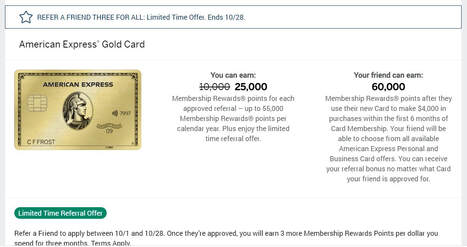

American Express Membership Rewards is one of the great flexible points currency which can be used by transferring to variety of Airlines / Hotels program and in the current COVID-19 situation you can even use it for gift cards redemption such as Home Depot or Best Buy. American Express Referral Offer is one of the best way to earn some valuable Membership Rewards points quickly. While American Express limits annual referral credits to $550 or 55,000 Membership Rewards points or other co-branded points currency, it has variable offer per referral based on the type of card you have. One of the best offer's for Membership Rewards Points earning is on either of their Amex Platinum or Business Platinum Card or Amex Gold Card. To top it currently till 10/28/2020 American Express has special offer for referrer where they can earn additional 3x points for next 3 months of their spend after the referred friend is approved. This is in addition to the fixed bonus points offer available for referral. For e.g. currently my Amex Gold Card would earn additional 3x points on all purchases for 3 months in addition to fixed bonus points of 25,000 Membership Rewards points after I have successful referral. The best part is the referred friend usually also sees better credit card earning offer as well compared to otherwise available public offers and thus a win-win for both!! One of the great things about Amex Referral Offer is that the referred friend can open any other card from Amex portfolio and is not limited to the card which referrer refers him to. The referred friend just needs to "click on the referral link --> View all cards with referral offer --> All personal cards " and select the card for which he/she needs to apply. Also some of these credit cards now have "6 months to meet the minimum spend offer"

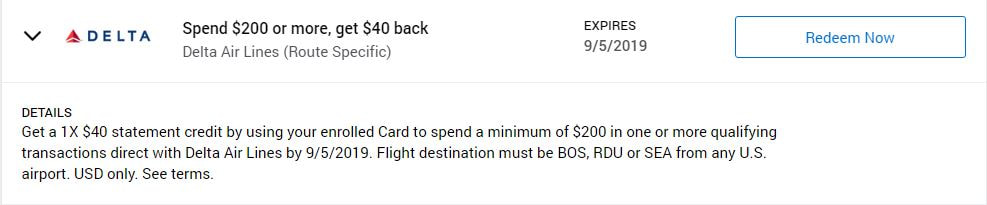

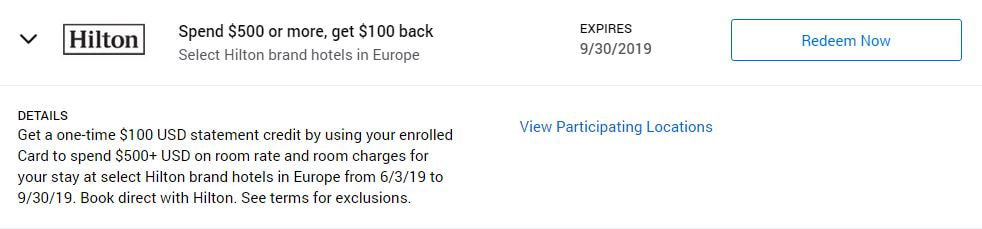

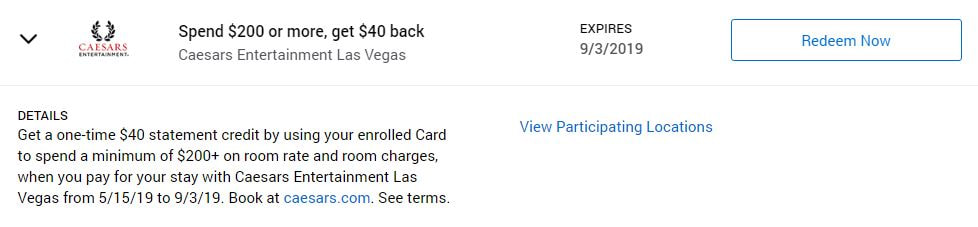

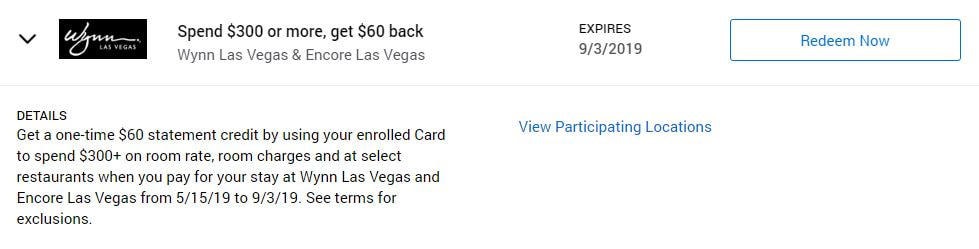

In addition Amex Cards comes with great Amex Offers program some of which we have covered here and here. So, check your American Express cards and if you know of friend who is looking for a new credit card than now would be the best time to refer!! Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  Amex Shop Small is already underway but you can still enroll your Amex card in this promotion till 08/23/2020. Through this promotion you can earn $5 back for any purchase of $10+ at participating small business merchant for purchases made till 09/20/2020. $5 cashback at small business can be earned 10x times, so in total you can earn $50 cashback with this offer. You can search your nearby small business merchant here. The best part is that this promotion is available as an Amex Offer which can be even added to Amex prepaid products such as Amex Serve / BlueBird. You may also be able to add this Amex Offer to other co-branded credit card's if you have them such as Wells Fargo Propel Amex Card. You might be surprise to find merchants which you might think are not small business but a qualifying purchase with them would earn you the $5 credit. For e.g. qualifying purchases at eGifter would earn you $5 credit where you can buy different egift cards. You can find additional surprise merchant's info on this DoctorOfCredit post. You can find complete offer terms here. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  American Express has one of the common benefit across all credit cards which is called Amex Offers. These offers provide discount in the form of statement credit or membership rewards points for purchase at certain merchants. While some of these offers are targeted, most of them are available to all customers. The offers usually have rebate in the range of 10% to 25% depending on the merchant. American Express also provides "Amex Offers for travel". Below are some of the offers available as of now. As you can see they are different offers available with hotels and airlines. For hotel offers, although you need to make booking online you can pay with the card enrolled in the offer at the time of check out. This also present's a nice stacking opportunity. For e.g. Hilton Honors Aspire Card provides $250 resort credit every year at participating resorts. This could easily stack with the $100 back on $500 spend on Hilton Brand Hotels in Europe if you have that offer added to your Hilton Credit Card and use it for paying at the participating resorts in Europe.

The other example of possible stack is if you have Delta Offer above of $40 back on $200 which can stack with the Companion ticket which comes with Platinum Delta Skymiles or Delta Reserve credit card. Since American Express only allows one Amex Offer of given type across all American Express card on person's name, it would be best to add the offer to the credit card where you can possibly stack. So, next time you see any travel Amex Offers do not forget to add it to the card where you can maximize it!! Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  American Express has lot of cards with no annual fee. Couple of popular no annual fee cards are Amex Everyday card and Amex Blue Cash Card which earns Membership rewards points and cashback respectively. American Express also has annual fee option available for these same cards and they usually differ in the earning's in categories. For e.g. the Blue Cash Card earns 3% cashback at U.S. Supermarkets whereas the Blue Cash Preferred would earn 6% cash back (On up to $6,000 in purchases per year). So, although the annual fee for the preferred version is $95 you do get 3% additional earning and so if you reach the max spend cap for the year, you would earn additional $180 which would easily cover the $95 fees. Interestingly American Express is known to provide upgrade offers usually in 2nd year of card membership. Depending on the type of card (Cash back or Membership rewards) you would either earn certain amount of points (for e.g. 10,000) or cashback (for e.g. $100) when you upgrade and spend certain amount on the upgraded card with 3 months or so. The good part is that these offers would show up on your American Express account and these is no hard credit pull or inquiry. Also since this is an upgrade offer they usually do not come with "once a lifetime bonus restriction". For e.g. one of our account has an offer of earning $150 by upgrading to Blue Cash Preferred and spending $1,000 with new card within first 3 months after the upgrade. Similarly if you have other partner cards such as no fee Hilton Honors card or Marriott card it might be worth checking if there are any targeted upgrade offer available. So, login to your American Express accounts and check for your targeted offer. Do note that if you never had the "premium" version of the card before you might be excluded to get the bonus again in future if you decide to apply for that premium card directly.

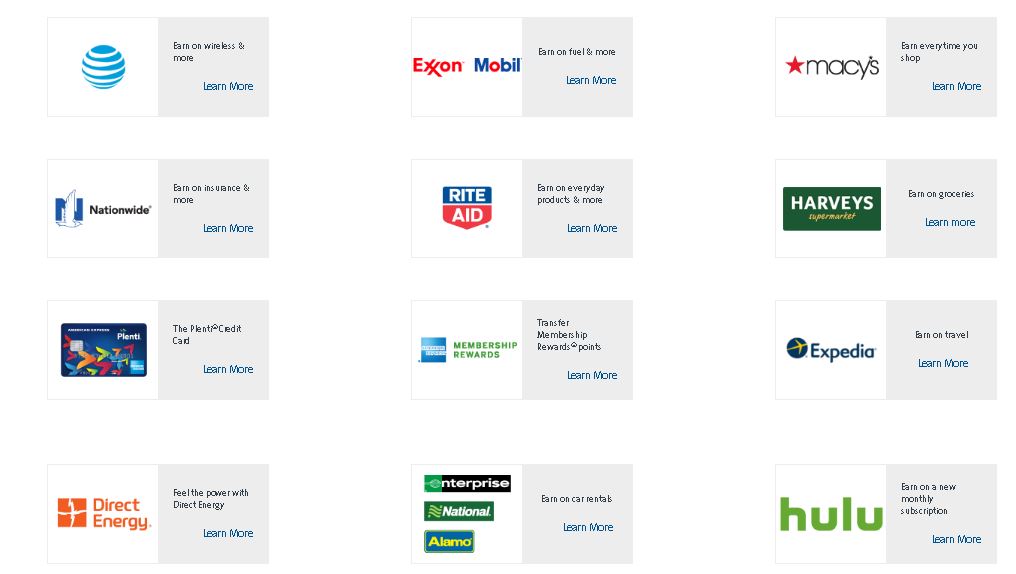

Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website. Its been long hiatus at this blog. So, why not re-start with something interesting. Today I want to talk about Plenti Points from American Express. I am sure you would have heard about it and if not you can check out the details here. The reason I want to talk about it is because till December 31st 2016 you can transfer your Membership Rewards points to Plenti at 1:1.5 ratio. So every 1000 MR (Membership Rewards) points transfers to 1500 Plenti Points. Also the transfer is instantaneous and you can transfer as often as you want. Below is the quick snapshot of locations where you can earn Plenti Points at as of now: Although you can earn on many partners the only partners as of now where you can spend are AT&T, Exxon / Mobil, Macy's and Rite Aid. Out of these partners AT&T and Exxon/Mobil are the most useful one as most of the folks would use Cellular Service and pretty much everyone needs gas for the vehicle (unless you are already on Electric Vehicle).

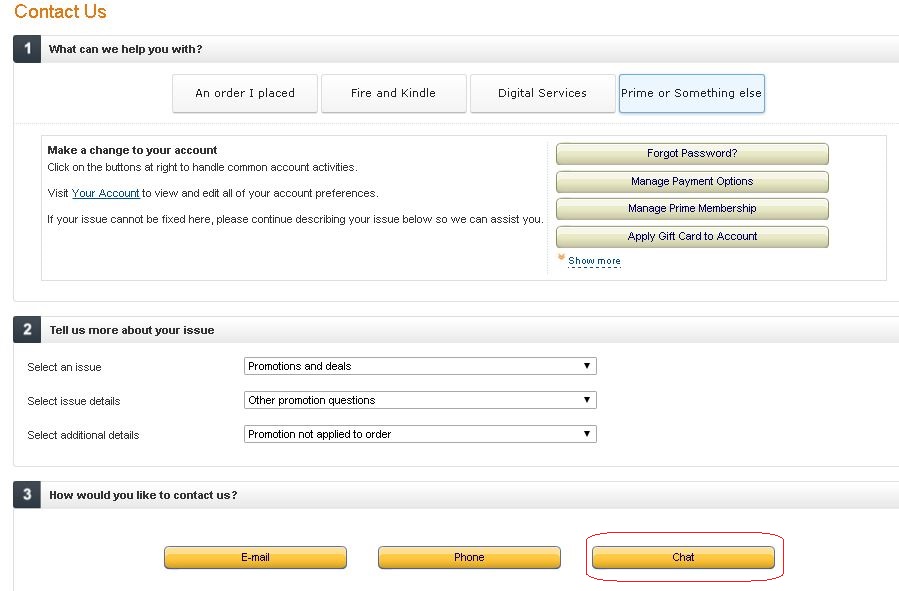

AT&T -- Primarily you can use to pay your postpaid wireless bill and In-store available merchandise (excluding gift cards). Exxon / Mobil -- You can pay for gas or any other purchase in-store (excluding gift cards). You need to have Exxon or Mobil Gas Station to take advantage of this though. The interesting aspect of Plenti is even if you use the points towards the payment you still earn Plenti points (Although, You earn 1 point/Gallon for Gas which is sort of peanuts, but they have frequent promotions for bonuses). So, if you do not have any better use (airline partner transfer?); rather than redeeming the Membership rewards points as statement credit it's better to redeem them at 1:1.5 ratio and use it to fill up your gas or pay your postpaid wireless bill with AT&T.  There are few great amazon promotions going on where you can score $10 off on $10 or $15 off on $50 purchase from Amazon for goods sold and shipped by Amazon. Here are the promo details: $10 off $10 or more purchase using pay with Discover Cashback Bonus The details of the deal can be found on this slickdeals thread, but the idea is you need to link your Discover Card to your Amazon account. Add $10 or more items which are sold and shipped by Amazon and select payment method to be Discover Credit Card with payment of at-least 1 cent from your Discover Cashback Bonus. In the promo code box enter the code "SWP07DFS10" on the check-out page. You should see $10 being taken off your purchase. Here is the link to the terms of this promo. $15 off $50 or more purchase using Amex Membership Reward Points The details of the deal can be found on this slickdeals thread, but the idea is you need to link your AMEX Membership points earning credit card to your Amazon account. Add $50 or more items which are sold and shipped by Amazon and select payment method to be American Express (AMEX) Credit Card with payment of at-least 1 cent from your Membership Reward Points. In the promo code box enter the code "SWP07AXP15" on the check-out page. You should see $15 being taken off your purchase. Here is the trick to make above work! Although the above promotions are "targeted" and may not work for your account, the trick to make both the above deals to work is chat with Amazon customer care which you have stuff added in your Amazon cart. Here is the link to that page. Select "1. Prime or Something else" --> "2. Promotion & Deals" --> "3. Chat" option and speak with the representative that you have this promotion but not able to apply the code and you will hopefully get $10/ $15 taken off your order or $10/ $15 credit for your future order. $10 off $10 Citi one-click setting change promotion

The reason I listed this in the end is because there is a way by which you can potentially make this work and get $10 off $10 or more purchase by making Citi Credit Card as your preferred "One-click setting credit card". This promo will appear automatically if you login on the "app" from your android device and you can just register for it. The other way to make it work is by using the steps on this slickdeals thread. There is no promo code required and the promotion automatically gets applied at the checkout when you select the Citi credit card as the form of payment. So, enjoy free credits from Discover, Citi and American Express (AMEX).  Flying the airlines used to be the traditional way of collecting miles on airlines for that dream trip, but thanks to the advent of "mileage earning" credit cards (where you earn miles/points based on spend on the credit card) it has become easier than ever to earn those miles to redeem for your dream vacation trip or that future trip which you have been planning for a while. With the help of credit cards, some effort from your end and lot of available techniques you could rack up those miles for your "award travel redemption". Some of these techniques are:

Let's see few methods which you can follow to generate the miles/points on the credit card of your choice by "Buying/Selling gift cards". Method 1: Buy gift card online for merchants that awards points/miles for their gift card purchase and exchanging those gift card in store for more valuable gift card. A common example where above method is used is Sears. Sears usually awards miles/points for purchase of their physical gift cards through various portals. For example if you earn 10 miles/$ spend ( or 10% Cash-back) on purchase of sears gift cards through the portal, later on which you can use to purchase Visa/MasterCard in the store (provided the store sells those and cashier is fine doing it). You could also use Sears gift card to buy other merchant gift cards such as Amazon or Shell (provided they are available and cashier is fine doing it). Purchasing $1k of Sears gift card would generate 10k miles/points ( or $100 cash-back) which could help you for that future trip. Method 2: Buy gift cards online at discounted rate and sell these gift cards at minimal loss on "gift card exchange sites". A common example of these would be to Buy gift cards online on Ebay when Ebay bonuses it by giving percentage discount of 8% or more or 4X or greater bonus Ebay Bucks. These could be then sold to various gift card re-sellers. You could scan through "giftcardgranny" for the resell value you would get before you buy the gift card on Ebay so that you know your profit/loss before hand. Method 3: Buy discounted gifts cards online for merchants that allow buying Visa/MasterCard or other better value merchant gifts card in-store or online using their gift cards. Again Sears would qualify here for in-store gift card purchase using Sears gift card. There are other stores which would allow you to do that. A useful place to browse for this is at Frequent Miler Laboratory. Walmart used to allow using their gift cards to purchase Visa/MasterCard online, but no longer does that. Hope these data helps you to get going in your miles quest for the upcoming trip. |

AuthorI love traveling / backpacking. This blog focuses on below 3 aspects of travel: This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

December 2020

Categories

All

|

RSS Feed

RSS Feed