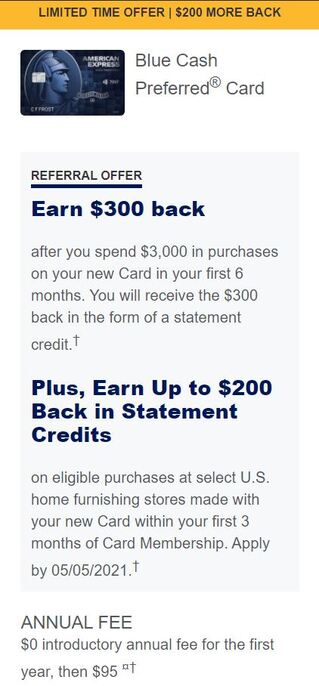

American Express has been on a tear with awesome credit card offers of late and to top it the current offers through referral where you get up to $200 additional statement credit for purchases at "select home furnishing stores" is just icing on the cake. The great part of the offer is that the $200 additional statement credit is available on many more credit cards which makes the sign up offer on those cards awesome, such the below offer on Blue Cash Preferred Card. Also the person referring using their personal Membership Points earning card would earn additional 4 points per $ spent up to spend of $25k for next 3 months in the same "select home furnishing stores" in addition to the fixed referral bonus after a successful referral is made. But this is Amex and you got to be careful on what Amex defines as "eligible purchases". As of late Amex has up their ante on clawbacks and you do not want it to happen to you. So below are the list of things which Amex considers ripe for clawbacks and it is better to avoid them then be sorry:

Even, the additional $200 statement credit which Amex is advertising for referral offer might be ripe for clawback if used in the way above and its better to be cautious then sorry! So go ahead for this awesome referral offers while it lasts but tread with caution as you are dealing with Amex. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.

0 Comments

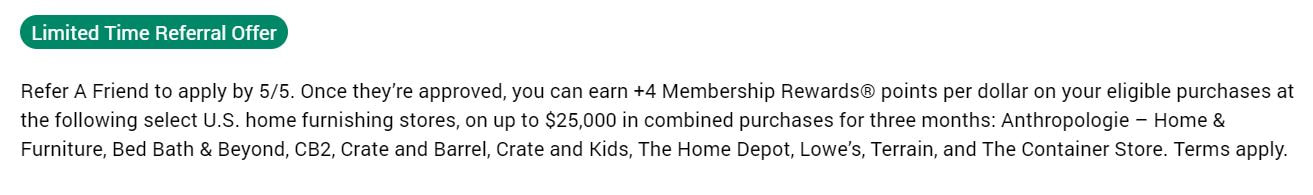

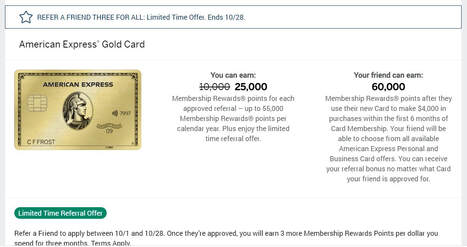

American Express Membership Rewards is one of the great flexible points currency which can be used by transferring to variety of Airlines / Hotels program and in the current COVID-19 situation you can even use it for gift cards redemption such as Home Depot or Best Buy. American Express Referral Offer is one of the best way to earn some valuable Membership Rewards points quickly. While American Express limits annual referral credits to $550 or 55,000 Membership Rewards points or other co-branded points currency, it has variable offer per referral based on the type of card you have. One of the best offer's for Membership Rewards Points earning is on either of their Amex Platinum or Business Platinum Card or Amex Gold Card. To top it currently till 10/28/2020 American Express has special offer for referrer where they can earn additional 3x points for next 3 months of their spend after the referred friend is approved. This is in addition to the fixed bonus points offer available for referral. For e.g. currently my Amex Gold Card would earn additional 3x points on all purchases for 3 months in addition to fixed bonus points of 25,000 Membership Rewards points after I have successful referral. The best part is the referred friend usually also sees better credit card earning offer as well compared to otherwise available public offers and thus a win-win for both!! One of the great things about Amex Referral Offer is that the referred friend can open any other card from Amex portfolio and is not limited to the card which referrer refers him to. The referred friend just needs to "click on the referral link --> View all cards with referral offer --> All personal cards " and select the card for which he/she needs to apply. Also some of these credit cards now have "6 months to meet the minimum spend offer"

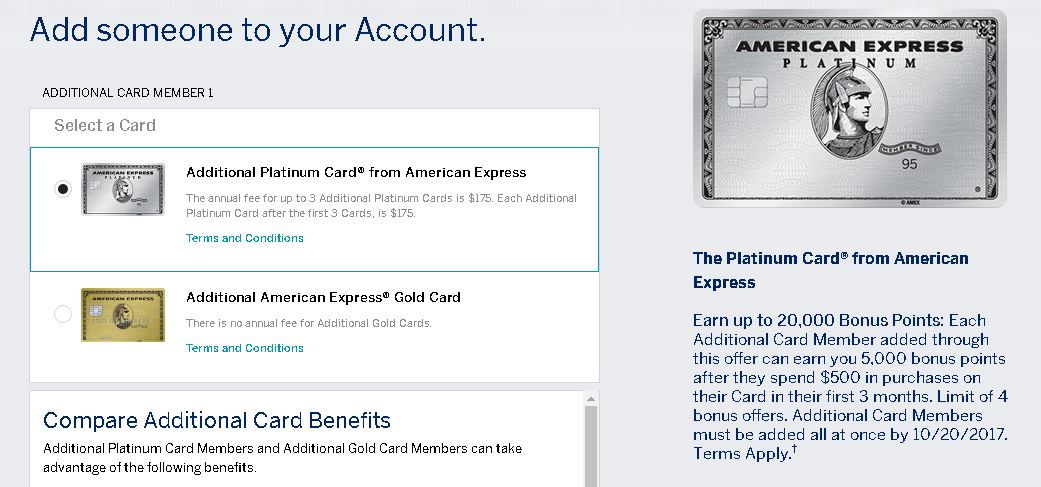

In addition Amex Cards comes with great Amex Offers program some of which we have covered here and here. So, check your American Express cards and if you know of friend who is looking for a new credit card than now would be the best time to refer!! Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website. Earn upto 20k Amex Membership reward points with Amex Platinum Authorized user cards [YMMV]9/24/2017 Lately American Express has been promoting their credit cards by giving away bonuses for authorized users on personal credit cards. There have been bonuses on some good cards such as 2.5k SPG points for authorized users on Starwood Preferred Guest, and 2.5k Membership Reward points for authorized users on Everyday Preferred card. One of the interesting offer is for authorized user on Amex Platinum Card where you earn 5k Membership Reward points for each authorized user upto 20k Membership reward points in total. This offer may not be available to all holders of Amex Platinum Card but you can check by clicking this link and login in to your Amex Platinum online account. The offer gives 20k Membership reward points in total for upto 4 authorized users when you spend $500 on each authorized user card but you need to add all of them at the same time. Also you can choose to add American Express Gold card for no extra cost if you are doing this just for membership reward points without the real benefits of the card.

Lot of the folks who have this offer would see it expiring on 10/20/2017 but quite a few might have different date of expiration so do check for expiration date before you apply for the offer. One other thing is you do NOT require to provide SSN for authorized users up-front. Even when the card arrives you can get away with activating the card by calling in and providing alternate evidence such as Passport instead of SSN number. Also being an authorized user does not exclude the authorized users from getting their own primary card in the future along with the sign on bonus if they never had this card before as a primary applicant. So see if you have this offer and if yes earning 20k Bonus Membership reward points with a total spend of just $2000 without a credit pull is a great deal. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  American Express (AMEX) has a nice perk of Amex Offers which at time can be lucrative in earning miles/points or cashback. If you have cards which earns membership reward (MR) points then AMEX at times is targeting with Amex Offers that earns Membership reward points instead of Cash back rebate. For e.g. below is the offer where you earn 2000 MR points for $100 spent at Best Western Hotels. As you can see from the above offer you would earn 2000 MR points instead of the usual offer which would be to earn $20 in rebate for the stay. Since Membership Rewards points can be transferred to myriad of travel partner airlines or use for redemption for airline revenue tickets (if you have American Express Platinum Business card), the offer to earn Membership reward points would get you a better redemption value than earning the cash back outright.

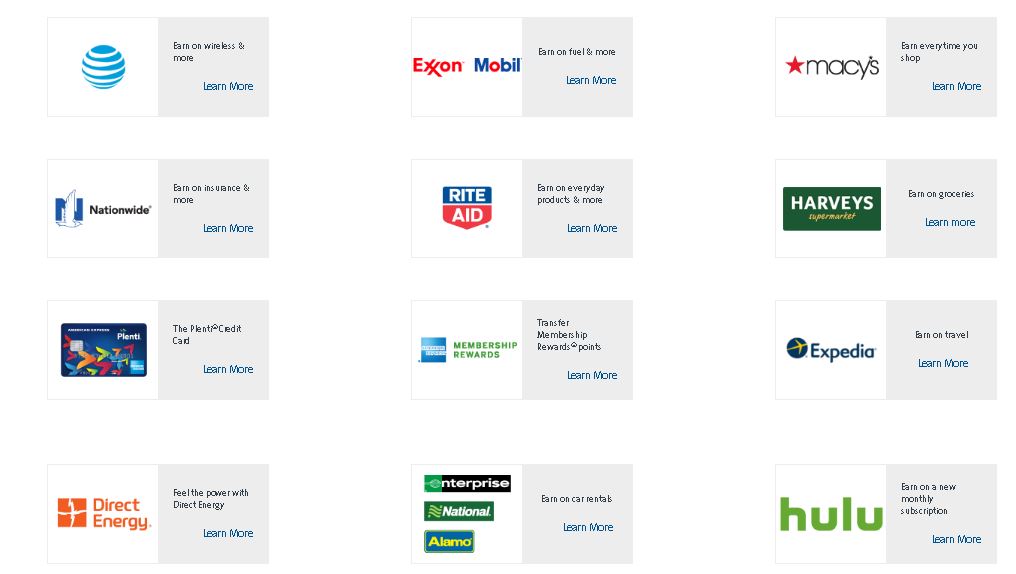

The only downside is that you need to be targeted for MR points offer as the usual Twitter hashtags for adding offers are always cashback offers. On the other hand if your Membership rewards earning credit card is targeted for an amex offer which earns MR points then all the other cards which do not earn MR points will not have the same offer at all. For e.g. none of your non-MR earning card will have the Best Western offer above. So, look out for those targeted MR earning offer and hope you can maximize them depending on which offers you get. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website. Its been long hiatus at this blog. So, why not re-start with something interesting. Today I want to talk about Plenti Points from American Express. I am sure you would have heard about it and if not you can check out the details here. The reason I want to talk about it is because till December 31st 2016 you can transfer your Membership Rewards points to Plenti at 1:1.5 ratio. So every 1000 MR (Membership Rewards) points transfers to 1500 Plenti Points. Also the transfer is instantaneous and you can transfer as often as you want. Below is the quick snapshot of locations where you can earn Plenti Points at as of now: Although you can earn on many partners the only partners as of now where you can spend are AT&T, Exxon / Mobil, Macy's and Rite Aid. Out of these partners AT&T and Exxon/Mobil are the most useful one as most of the folks would use Cellular Service and pretty much everyone needs gas for the vehicle (unless you are already on Electric Vehicle).

AT&T -- Primarily you can use to pay your postpaid wireless bill and In-store available merchandise (excluding gift cards). Exxon / Mobil -- You can pay for gas or any other purchase in-store (excluding gift cards). You need to have Exxon or Mobil Gas Station to take advantage of this though. The interesting aspect of Plenti is even if you use the points towards the payment you still earn Plenti points (Although, You earn 1 point/Gallon for Gas which is sort of peanuts, but they have frequent promotions for bonuses). So, if you do not have any better use (airline partner transfer?); rather than redeeming the Membership rewards points as statement credit it's better to redeem them at 1:1.5 ratio and use it to fill up your gas or pay your postpaid wireless bill with AT&T. |

AuthorI love traveling / backpacking. This blog focuses on below 3 aspects of travel: This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

December 2020

Categories

All

|

RSS Feed

RSS Feed