|

The big question for most of the folks after signing up for credit card is how do I meet minimum spend requirement? Good offer might have a minimum spend of $2.5k to $3k to be done within 3 months. Now if you get 3 such cards, voila you need to meet ~$9k in 3 months. Don't worry, there are quite a few number of ways which can help you with that. Some of them are free (small hassle) while some are easy but has small 2% to 3% cost associated. Before we start there is a great article here by millionmilesecrets which will get you started. Let's look into the free one's below:

1. Doing FAR (Free After Rebate) Deal: Lot of store's will have FAR (Free After Rebates) promotion now and then. The most easiest and frequent one is from Staples where you do every thing online including even submitting of the rebates form. Heck, you can even earn bonus points on this. Check out FrequentMiler blog to learn more on this. OfficeMax frequently has FAR deal, but albeit it earns MaxPerks dollars which you can redeem in only OfficeMax. If you are a regular shopper at OfficeMax then this could be for you. Freebie-depot is another place which lists the FAR products from brick & mortar and online store. (Albeit you have to pay taxes on these deals). 2. Amazon Payments: You could do a transfer of up to $1k/month from Amazon Payments account to your partner/friend Amazon Payment account using a credit card. Your partner/friend can then transfer that amount to his bank account and pay you by Check or Cash. Make sure you do not transfer money back and forth between your's and your partner/friend Amazon Payment account or your account might be flagged. This is the best way of meeting your spend requirement in short time without any charge. 3. AMEX Serve Prepaid Card: This is another card which can help you meet some spend requirement. Currenly Serve currently allows up to $250 of loading through your credit card without any additional fees (Citi Credit Card which ideally charges Cash Advance for money loading on prepaid cards also seem to work as purchase). You could also get free $25 when you open Serve and load $25 on it through your bank account before September 30th. Here is the link for the deal (There is no hard credit pull when you take this card). 4. AMEX Reloadable Prepaid card: This is a good deal if you can buy the Reloadable Vanilla Card at office-depot using credit card. You would also get $25 if you open AMEX Prepaid account and fund it with $200 before August 31st. Here is the link. (There is no hard credit pull when you take this card). 5. Buying Gift Cards: If you know you would have future purchases from Amazon you can buy Amazon Gift Cards from any brick & mortar stores (grocery stores or office item stores). You could even buy other major chain gift cards such as BP Oil, Jiffy lube, Lowe's from these stores to be used for your future purchases. 6. Wells Fargo Prepaid Card: This has some fee associated but a great way of meeting your minimum spend requirement. You can load up to $2.5k per day. There is a great article by View From the Wing blog which describes the details of this. You can check his blog here. 7. Buying AMEX/VISA/MasterCard: You could even buy these prepaid gift cards from stores that allows you to buy them using Credit Cards. Many stores like Kroger, Office-depot and Office-Max will allow you to buy these cards using credit cards but YMMV. You will need to find the stores that allows this. Since these cards charge an additional purchase fee of $5.95, its best to buy a highest value card of $500, thus minimizing the out of pocket additional cost to ~1.2%.

0 Comments

Once you start collecting miles and money the next question is how to track them. Traditionally you could make a spreadsheet to track the miles and money on various programs and cards. But hold on, there are easier ways to track them and it will also help you not to lose those miles and money. On top of it these programs are free to join and you can access most of the desired features using the basic account itself. I have listed few of the tracking tools below. Miles & Points Tracking Tools: Award Wallet: This one is my favorite. This program not only tracks most of the airlines (Southwest Airlines and American Airlines are notable exceptions) and hotels but also various credit card loyalty programs, shopping, rental, dining, trains as well as surveys! Few of the notable features are listed below 1. Tracks miles and points balances for most of the reward program without any limit to number of programs you can add to the account. 2. Single account can track rewards for multiple family members and friends. 3. Option to store the passwords on your local computer so as to avoid any unfortunate compromising of account details. 4. Track all the upcoming trips. 5. Track miles & points expiration date so as to avoid losing your valuable miles. UsingMiles: This program is very similar to Award Wallet. Some of the features are below: 1. It can keep track of miles and points as well as you can access bonus offers. 2. You can also track the miles and points for multiple family members and friends. 3. Dashboard feature allows toe see snapshot of all the programs you have miles and points on the front page. 4. Keep track of deal sites such as Groupon and LivingSocial. MileTracker: This program is a USA Today product and has similar features for tracking all the miles & points and having one consolidated view of the same. 1. It can keep track of miles along with their expiry dates. 2. You can also track the miles and points for multiple family members and friends. 3. Check account history and recent transactions using miles and points. 4. Track any upcoming trips. Money Tracking Tools: GoWallet: If you are one of those who buys variety of gift cards to maximize earning cash-back or miles/points than this one is for you. GoWallet store all the gift card information at one place. You can access the information on the go using their Android or Iphone App as well. Below are some of the features: 1. Access your gift card information online or on the go. 2. It tracks gift card balances and thus you know when to throw away that gift card when it has run out of balance. 3. You could also use the information stored in the account to retrieve stolen or lost card information. 2. WildCard: This is a free Iphone App with rich features of using the App directly to buy stuff using the gift card at participating stores. The downside is not all stores are participating in the program. 3. GiftCard: This Iphone App is $0.99 in Itunes store but its week/pale compared to GoWallet. How do you track your miles/points and gift card balances? Let me know in the comments below.  Most folks think that Cashback is a very small incentive of which one should not care much. I would like to give you a glimpse of how much can you save with cash-back as well as why it is one of the secret weapon in saving in your day to day life. Let's start with a typical credit card. Most credit card with offer you 1% Cashback on all of your transaction and have no annual fee on them. While getting 1% is good you can do much better than that! Below is a glimpse on how much you can potentially earn in Cashback with your credit card in brick & mortar stores. The trick is to use specific Cashback card for given category of purchases and the acceptance of Visa/MasterCard/AMEX in those stores. Below I have listed how much you can earn in Cashback and the specific card/cards which helps you with that. Also certain card's carry annual fees but if you have lot of spend on the card with annual fees it may very well be worth it. 6% Cashback on all the grocery purchases at supermarkets (excluding warehouse club like Costco and Sam's club -- Hey but there is a work around for that as well!! Keep reading!) a. American Express Blue Cash Preferred - $75 Annual fees 3% Cashback on gas stations a. American Express Blue Cash Preferred - $75 Annual fees b. Costco True Earnings Card c. Bank of America BankAmericard Cash Rewards 3% at department stores a. American Express Blue Cash Preferred - $75 Annual fees 2% on Travel & Dining a. Chase Sapphire Preferred - $95 Annual fees b. Costco True Earnings Card If you are looking for a no fee card than check out Chase Freedom or Discover More card with its 5% Cashback on rotating bonus category every quarter. (5% cash back on Max $1500 spend in bonus category and you need to register for bonus every quarter) How to Maximize your Cashback in stores: 1. If you are using American Express Blue Cash Preferred card you can shop for gift cards at grocery stores like Safeway and Kroger for other stores from which you actually want to buy stuff. For e.g. you could buy gift cards for Staples, Chili's, Southwest Airlines, Lowe's etc etc.. and potentially earn 6% on those and then use those cards to do the actual buying in your favorite store. You can even buy gift card's for Shell, BP and Amazon thus earning you 6% for those purchases. 2. If you are using Chase Freedom or Discover More card to do the shopping at 5% category bonus store you should check out those stores to see if they carry the gift card of your favorite store. Essentially these gift cards would already yield 5% Cashback on your future purchases. 3. What if the bonus category store does not have gift card for your favorite store? Do not worry! You could buy an VISA, MasterCard or AMEX Prepaid gift card using your credit card. Make sure you buy the highest denomination card as these cards usually have fees ranging from $3.95 for $25 card to $5.95 for $500 card so it would be worth the hassle if you buy $500 card. This will eventually drop your 6% Cashback to ~4.8% or your 5% Cashback to ~3.81% but its still better than getting 1% Cashback. How to Maximize your Cashback for online purchases: 1. Using your credit card and going through Cashback portal to your favorite store: You could shop by first checking Cashback website's such as CashBack Holics, Evrewards & Topcashback to find out the portal which awards best cash back rates for your favorite online store. The good ones in my opinion are Ebates, MR. Rebates, Topcashback, Ultimate Rewards (Only for Chase customers) and ShopAtHome. You could even earn Cashback for your flight reservation, hotel booking or bidding as well as for your dream vacation. So do not miss to cash on this opportunity 2. Buying gift card's for your favorite stores and then using those gift card's to make online purchase: There is huge secondary market which sells gift card's at discount of anywhere from 3% to 30% for most of the chain stores you wish to shop online at. You can compare the rates at Giftcardgranny before you start. Two of the popular gift card resale sites are Plastic jungle and Cardpool. You can even earn cashback while buying gift card using Topcashback. So essentially this creates a "double-dip" situation where you buy the gift card online at a discount and then use the discounted gift card to make the online purchase at your favorite retailer online store through a Cashback portal giving you some more Cashback. You can even do a potential "triple-dip" with a little more work by first buying VISA/MasterCard/AMEX branded prepaid gift card from your 5% or 6% credit card Cashback awarding store and using the prepaid card in turn for buying gift card online. Do note some online stores DO NOT award Cashback when buying stuff using the "store gift card", so you might want to check the terms for Cashback. 3. Using the VISA/MasterCard/AMEX prepaid gift card for Online shopping: So you bought this gift card at a 5% Cashback category bonus store or 6% Cashback grocery store. You can register these cards on your name and use them for the online purchase as well earn Cashback from the online Cashback portals. Since the Cashback from online Cashback portal ends up in your account with that portal and NOT to your prepaid gift card, you do not need to worry about the gift card once the funds are exhausted (The only time you might be worried is when you want to make a return of the purchase and thus will need to keep the prepaid gift card safe with you). 4. Shopping at Costco at a Cashback of ~4.8% or ~3.8%: Since you could buy a prepaid VISA/MasterCard/AMEX at the bonus category store or the grocery store, you could use that to buy Costco Gift card online through Costco website. Here is the direct link to the page. The best part is you could make a purchase using VISA or MasterCard where as in store you can only use AMEX branded card. Hopefully you learnt something which you can use for your daily purchase. Did I miss anything? Anything else you would like to add? Disclaimer: None of the links above earn me any referral.  Your Problem: Imagine the situation that you have earned miles for flying one of your less favorite airlines last summer and accumulated few thousand miles but have no use for them. Or you stayed in that wonderful and expensive hotel and earned some of their loyalty program points but do not know what to do of those? If you have face one of the above situation and want to get some value out of otherwise "wasteful" miles and points than you have "points.com" at your rescue. If you have never heard about points.com or have heard bad things about points.com than stay with me as I would take you through some hidden gems of this program while avoiding the popular mistakes. Below are few features listed: Key features: 1. The program is free to join. 2. It allows to exchange, buy or trade miles and points between various participating airline and hotel programs albeit at some cost. 3. You can redeem the unused miles or points for either Paypal cash or gift cards. Analysis of Points.com: Since points.com is free to join and you can potentially exchange, buy or trade your miles/points, it has some great value to offer if you use it correctly. Remember airlines and hotels do not want you to exchange or trade your otherwise useless miles and points as they know exactly that they are "useless". Points.com comes to rescue by getting some value out of those "useless" miles/points. Below are few hypothetical but could be real scenarios which would give you great value out of this program. Scenario A: You have 2000 Elevate miles accumulated in Virgin America from the last flight you took for which you have no use of. You are planning to just forget about those miles and move on... Solution: Hold on.. below I have listed few of many options available using points.com. You can trade 2000 Elevate points for: 1. 1580 US Airways Dividend miles 2. 878 United Mileage plus miles or American Airlines AAdvantage miles 3. 1700 Cathay Pacific Asia miles 4. 1700 Priority club points You can check the complete list of available options here. Scenario B: You are short by 43 miles for United Airlines Mileage plus reward level of 12500 points. You want to book the reward within next few days but do not know the cheapest way of getting those 43 miles quickly. Ideally if you want to buy from United Airlines you will need to buy in multiples of 1000 points at a cost of $35/1000 points without any ongoing promotion. Solution: You realize that you are member of US Airways Dividend miles and you have about 250 dividend miles accumulated from the new member promotion they had some time back. You quickly log-on to points.com and you find that you can get 43 United Mileage plus miles in exchange of 200 US Air Dividend miles. Although looks like a poor conversion ratio, but hey mind you are saving $35! The complete list of option's for US Airways can be found here. Scenario C: You have accumulated 6500 points on your flight with Cathay Pacific Asia miles more than 2 years ago. These points are going to expire soon and you do not want to transfer to any other airline partner Solution: You can redeem 6353 points for $27 in Amazon credits good towards any purchase on Amazon.com You can also trade miles from one program to another, but these are generally based on availability and usually costs almost the same as buying points from the Airlines directly. Your specific situation might vary depending on trade available etc As you can see from above scenarios, that points.com best value lies in exchange where you have few thousand "useless" miles and sometimes in redemption of soon to expire miles. Also programs like Frontier Airlines do not allow you to redeem their miles for anything except flight reward or magazines, so you could potentially extract more value by using points.com for Frontier Airline transaction. Below is the list of few popular points.com participating airlines and hotels:

Lot of folks think that you can accumulate airline miles and hotel points only by flying or staying at hotel. Flying and staying in hotel are definitely good way of accumulating miles/points, but that would cost lot of $$ if it were the only way. There are ways much beyond that which can help you take that free flight or a hotel stay. Most of the miles and points hoarders are creative when it comes to accumulating stash of miles and points. In this post I will highlight few ways of getting on with this. 1. Credit Card Signup bonus: If you are one of those with good credit score and do not have need for "real" bank loans or mortgage this one is by far the most easy way to accumulate lot of miles and points. The best way is to do a little research before signing up for new cards so as to get the "best available bonus". Most of the best deals are available here. You could potentially take up to 2 or 3 credit cards every quarter without affecting your credit score. Make sure you apply for credit cards which are spread across Equifax, Experian and Transunion. You can find which credit-agency report is pulled for a particular credit-card application by searching the database here for your state of residence. If you are wary that "too many credit cards would spoil your credit history" I would say that is simply not true. As a safe bet you could easily do 4 to 6 credit-card applications in a year. 2. Daily purchases using credit card: Since most of the airline or hotel co-branded credit cards earn's you miles or points, using these cards to spend on things of day to day living would also help you to accumulate miles and points. Some credit cards also has category bonus points for shopping on grocery, dinning, gas or travel. Using the card that earn's bonus points for purchase in that category can increase your earning rate quite rapidly. Take for instance Chase Freedom Credit Card which earns 5x rotating category bonus where the category changes every quarter, or Chase Sapphire Preferred Credit Card which earns 2x points on travel and dining. So know your credit cards and earn bonus points by doing what you do everyday! -- Purchasing stuff you need. 3. Airline / Hotels bonus promotions: You will always find that the airlines / hotels run promotions where you earn bonus miles or points for flying a specific route or staying for X number of days. If you are anyways going to fly or stay in a hotel why not take advantage of this promos to earn more miles and points. To maximize your earning and get targeted promotion you can register for the mileage account for airlines you would want to use for your dreams vacations as well as for the points account of your preferred hotels. You can check frequentflyerbonuses website for all the latest promotion available. 4. Airline & Hotels partner earnings: This is the most unknown/neglected and easiest form of earning lucrative miles and points. Each airline and hotel have ongoing promotions with various vendors like car rental companies, online streaming companies ( for e.g. Netflix), wireless/internet connection companies (verizon, t-mobile), financial companies, identity theft protection companies, home security companies, energy delivery companies etc etc. These are valuable miles for services most of which you might be using anyway. For all the available partner offers you can visit the airline/hotel home page and search for partner offers. For e.g. here is the link for United miles earning partner offers. 5. Dining partner network: Lot of airlines and hotel groups partner with Dining partner network, where in you earn additional 3 to 5 miles per dollar for dining at their in-network restaurants. You can register for this as you would be surprised to find lot of restaurants where you lunch or dine anyways are partners and can earn you miles. You can register here for united partner dining program. 6. Online Shopping portal: Most of the airlines and few hotels have their own shopping portals which would earn you "miles" rather than cash-back. These websites also have promotions going on now and then which would award bonus miles for meeting specific spend on them. The beauty of these portals is that most of the stores where you shop anyways are listed on there and thus you can earn miles/points by shopping online at these stores through the shopping portal. You will find stores like walmart, target, home depot as well as amazon on these shopping portals! You can take a look at United airlines online shopping portal to see what I mean. To check which portal gives the best miles/points or even cash-back refer to my post on getting started. So how are you earning miles and points today? Let me know if I missed something in this list? Your feedback is welcomed.  Other day I mentioned about earning 2k Wyndham rewards points for $1. Now Wyndham has come up with stay 1 night and get 1 night free (16000 points) promo for stay in its 20 newly opened hotels. You can earn up to 3 free nights (48000 points) by staying 3 different times from 6th August 2012 to 9th August 2012.16000 points can be converted to 6400 miles for most major US airlines. A very good promotion if you can stay at any of the participating hotels. You need to be a member of Wyndham Rewards and although it says you need to click through the email received by you; you can go through this link and reserve the room. The full terms and conditions are listed below. *To qualify for the "16,000 bonus Points" promotion (the "Promotion") and earn 16,000 Wyndham Rewards® points, the member must (i) be an active member (ii) click through the email and book a stay at any of the 20 participating properties at a qualifying rate between August 6, 2012 and October 6, 2012 and complete their hotel stays by October 9, 2012 (the "Promotion Period"). Members will receive 16,000 Wyndham Rewards points for up to 3 stays within the Promotion Period at any of the 20 properties regardless of the number of rooms booked. 16,000 bonus points is redeemable for one free night stay at a Tier 4 hotel. Member stays with check-out dates after October 9, 2012 will not be counted towards the Promotion. One stay includes all consecutive nights at the same hotel regardless of check-ins or check-outs. For a full list of the 20 participating properties click here. Members should allow six to eight weeks after completion of stay for the bonus points to be credited to their account. The first question everyone has on great miles earning or shopping deals adventure is how do I get started? You can check the newly created Newbie Lounge for more info on getting started.

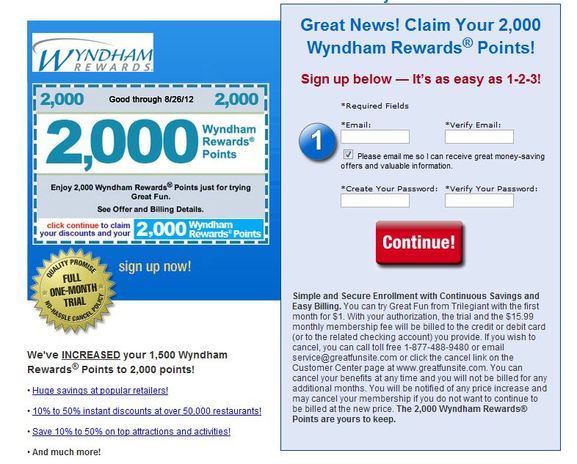

This is a good opportunity to get 2000 points for $1. Whether you are collecting points to have a free stay at any of the Wyndham brand hotels or simply collecting points to convert them to miles. Register at greatfunonline using this link. You can cancel the membership within 30 days of membership with no additional fees. Points should post in 4-6 weeks . Make sure you have Wyndham rewards membership [click here to become member] before you register for greatfunonline promo. You can redeem points for free hotel stay starting from 6000 points and transfer to airlines from 8000 points [8000 points is 3200 miles for most transfer partner airlines]. Enjoy! |

AuthorI love traveling / backpacking. This blog focuses on below 3 aspects of travel: This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

December 2020

Categories

All

|

RSS Feed

RSS Feed