Qatar Airways is a one of the premium airlines to travel with due their amazing business class and first class cabins as well as great service. They are Oneworld alliance partner so you can travel with them using other partner airline miles. While not widely popular Qatar Airways miles earning Privilege Club program (referral link) has some gems in it and recently they have made the program a little inline in terms of award price for travelling on their own metal compared to other Oneworld piers. They have also revamped the program where the Qatar Airways "Qmiles" now no longer expire if you have any earn/spend activity within the last 36 months. If you are not a member Qatar is offering a 5,000 bonus miles when enrolling before 30th April, 2021 using a referral link (1,000 miles upon enrollment and remainder 4,000 miles after taking the first flight before 30th Sept 2021). Also the referee earns 2,000 bonus miles for each referral who enrolls using the link and after they take their first flight with Qatar Airways. For folks who are already member of the Qatar Airways Privilege Program and have Qmiles earned and due to expire, Qatar Airways had extended the miles till end of March 2021 which means those miles will be expiring soon!! Earlier Qmiles would expire after 36 months regardless of activity but with the change in program you can now extend those soon expiring miles for another 36 months by any earn or redeem activity!! So, if you have your miles expiring continue reading on how to extend them..

Here are 3 easy ways to extend your miles:

So, get going and if you have Qmiles expiring extend them now before they expire. (P.S. You might be lucky if Qatar Airways decides to extend them further for free but you might not want to take your chances :)) Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.

0 Comments

Citi ThankYou points are useful for transfer to various airlines partners with most notable use for travel to/from Hawaii using Turkish Airlines Miles & Smiles program (7.5k points each way) if you have their Citi Premier Card or Prestige Card. Due to COVID-19 though most travel is down due to travel restrictions in place and so getting an alternate way of redeeming points is a great plus. With Citi Premium card Ideally you could redeem your Citi ThankYou points for 1:1 ratio for gift card's. But on 11/30/2020 starting at 12 a.m. EST for 24 hours you can redeem your Citi ThankYou points for certain gift cards at 20% discount and more importantly it includes the "Apple gift card". Since Apple recently changed their gift card so that it can be used for both Itunes as well as Apple products it could represent screeching deal to purchase those at 20% discount. In addition if you hold Citi Reward+ Card then you would get 10% ThankYou points back as rebate. So if you are redeeming for $100 Apple gift card with 20% discount you would pay 8,000 Citi ThankYou points which will further reduce to just 7,200 points if you hold Citi Reward+ card thus essentially making it 28% discount on Apple gift card (1000 points = $10). So, if you have healthy stack of Citi ThankYou points and no immediate idea of where to use it this might be a great deal to redeem those points.

Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  One of the best card's for extended warranty is Citi. While American Express extended warranty claim is much easier to get approved, AMEX only provides up to 1 year of extended warranty where-as Citi provides up to 24 months of extended warranty. Citi's extended warranty adds 24 months to any original manufacturer warranty or purchased extended warranty from vendor/service provider with maximum vendor/service provider of 5 years. So effectively you can get total of 7 years of extended warranty. The best part is you can get this extended warranty with No annual fee Citi Reward+ credit card. Below are some of the baseline terms. For complete benefits guide you can look up "card benefits" section after login in to your citi online account:

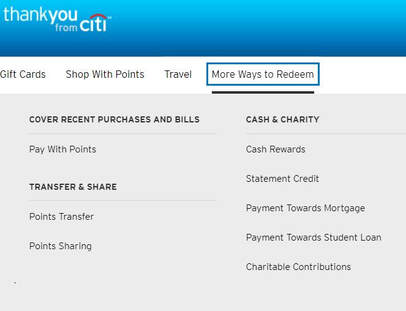

So, let's say for example you buy a cooking range from Home Depot and you purchased extended warranty of 5 years. You will get additional 24 months of coverage extending your warranty to total of 7 years! If you do not want to pay for the extended warranty from Home Depot than you would still have 1 year of manufacturer warranty (usually) and additional 24 months of extended warranty from Citi. (Note: You need to have some manufacturer warranty provided or else Citi's extended warranty does not apply!) You also get reimbursed only for the amount paid with Citi credit card/Thank You points. so ensure that you put full purchase charge on Citi card to get the full benefit. One important thing to check is that even within Citi the extended warranty benefit is not available across all credit card's. For e.g. as of this writing this benefit is not available with Citi Double Cash Card . So do check the benefits of the card before using it for purchase. You can find all the Citi credit card's here. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  With most of the folks not looking to travel in next few months and uncertainty around travel some of us would be thinking of how to best preserve cash. Most of the flexible credit card points program in the U.S.A such as Chase Ultimate Rewards, Citi ThankYou points allows one to cash out the points for statement credit or cash in checking/savings account. If you have a big stash of these flexible points and no near term travel plan it may be prudent to cash them out. While Chase Ultimate Rewards makes it easy and gives a value of 1:1 (Every 1,000 points can be redeemed for $10 in cash) Citi ThankYou points gives a real bad value of 1:0.5 (Every 1,000 points can be redeemed for $5 in cash). How to maximize cash out of Citi ThankYou points? Citi ThankYou points allows few ways of cashing out the points.

Alternative option of gift card!! You can redeem Citi ThankYou points for gift cards at 1:1 ratio. While not as good as cold hard cash, you could still redeem for plethora of merchants such as Target, Lowe's , Home Depot, Best Buy etc. This would give flexibility of getting close to 1:1 value which otherwise you would not get. You can also sell this gift card at some of the online re-sellers and still get `~90% of the value of gift card as cash getting a redemption ratio of 1:0.9 (1000 points for a value of $9) which is better than 1:0.5. Getting a Citi Rewards+ Card for Better Redemption value:

Citi has a no annual fee Citi Rewards+ Card which gives 10% back in points for any redemption of Citi ThankYou points (Maximum of 10,000 points back per year). If you have this card and redeem for gift card than you can potentially get close to ~1:1 ratio as you would receive 10% back in points. So, do remember alternate option as they might be better of than taking a direct "cash reward" or "statement credit" at reduced value. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  You can get free $10 in amazon credit if you have any Eligible Citi credit card by making it default payment for Amazon one click settings. Here is the link to the offer. This promo has been around for a while but if you have not taken advantage of it then you can register your Citi Credit Card on amazon.com for this promotion. The promotion is valid till Aug 15, 2017. If for some reason the offer page says that you are not eligible for the promotion you can remove all the Citi Credit card from your Amazon.com profile and try registering through the link after 24-48 hours of removing the Citi Credit card. Below are terms from the offer page for your convenience: TERMS AND CONDITIONS

Hat-tip: [Doctor Of Credit]  Every mileage currency has some sweet spots and "Etihad guest miles" are no exception. Ideally folks would not want to collect the "Etihad guest miles" but knowing where the value lies you might be able to decide if it's worth having them for specific redemption. As of starter if you are based in USA you can transfer Citi ThankYou Points or SPG Points in "Etihad guest miles" program at 1:1 ratio. In fact as with other partner airlines transferring SPG points in 20,000 increment will fetch 25,000 miles so your ratio could be as good as 1:1.25. The focus of the post is to list the Etihad guest airline partners and how to get value out of your Etihad guest miles. First of all let me list the airline partners for redemption: You can click "know more" on each of the partners on this link to see redemption details. Preferred Airline Partners:

Airline Partners:

As you can see that's a pretty long list. Also mind you each partner has their own redemption chart, so it might take you some time to wade through the redemption tables for each one of them, but in general below are the rules of award redemption for partner airlines (Mind you that these are general rules for all airlines and there might be additional rules specific to given airline partner): Award Redemption Rules (general):

How to book partner airline award redemption? Unfortunately you cannot do partner award redemption online. You need to call Etihad guest support on +1888 8 ETIHAD or 877 690 0767 and luckily they are open 24 hours. It would also be prudent to verify if the award you are looking for is available (usually saver level awards is what Etihad can book) by checking on the partners web site or paid tools like Expert Flyer or KVS. How many miles does Etihad charge? Most of the partner redemption chart are distance based (except few airlines including American Airlines). That means short distance flights which are otherwise expensive can give you best buck for your miles. That being said, below are few examples airlines, redemption on which could be a good value: Jet Airways Award redemption for International or Domestic Travel: You could book one-way from Colombo (CMB) in to Chennai (MAA) in Coach for just 3103 Etihad guest miles and with NO Colombo Sales City tax of ~$60. The same would cost 4500 British Avios with additional $60 if redeemed on SriLankan Airlines. Garuda Indonesia redemption for short distances: For e.g. you can book Bali (DPS) to Surabaya (SUB) flight for only 5000 Etihad guest miles. American Airlines for North America to South America (Zone 1): You can redeem 17.5k Etihad guest miles for travel from North America to South America (Zone 1) one way in coach. As you can see from some examples there are definitely some value to be had with Etihad partner redemption if you do not mind calling their redemption center. So, there are definite sweet spots that can be utilized using Etihad guest miles.  Most often than not on your trip you rent a car and its good to know what all the available options are as well as which websites would fetch you the cheapest car rental cost. To start with there are two kind of rentals you could book:

Opaque Booking: When you book the car rental using this kind of service you are typically renting through 3rd party travel agency site. Below are the advantages and disadvantages of this kind of rental: Advantages:

Transparent Booking: This is how typically you would book you car rental using either 3rd party OTA websites or the car rental agency website. The only disadvantage if you might end up paying a higher price then otherwise you would pay using the "Opaque booking", but the advantages are many as listed below: Advantages:

With that being said for "transparent booking", below are some of the websites which you would find useful for finding promotion / discount codes before you would go ahead and make your car rental reservation or could help you in getting the best available price for your next car rental. Promo Codes / Discount Codes Websites:

Car Rental Booking Websites (OTA): Below is the list of websites which generally tend to give good discounted rates for car rentals. Some of them are limited to access for "members only", but if you have access to them it would be really useful. You would want to try at-least 3 of them before concluding the best available price.

Note: None of the above links are referral links or earns me any commission. Thanks for reading! |

AuthorI love traveling / backpacking. This blog focuses on below 3 aspects of travel: This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

December 2020

Categories

All

|

RSS Feed

RSS Feed