Chase Ultimate Rewards are one of the valuable flexible currency for transferring to travel partners (various airlines and hotels) as well as for redeeming at 1.25x or 1.5x for travel or for now to "pay yourself back" on variety of purchases such as Grocery and Dining. At the same time it is hard to acquire Chase cards due to well know "5/24 rule" where in short Chase would not issue you a card if you have 5 or more opened account in the last 24 months. One great work-around if you have family and friends to support you is the Chase credit card referral offers. Currently you can earn 20,000 Ultimate Rewards Points for each referral (Up to 100,000 Ultimate Rewards points per calendar year) if you posses the Chase Sapphire Preferred or Chase Ink credit card. The icing on the cake is the person who you refer will earn an all-time high "100,000 Ultimate Rewards Points" for Chase Sapphire Preferred and Chase Ink Business Preferred (After meeting minimum spend). Also other No-annual fee Chase Ink card's earn 75,000 Ultimate Rewards Points as sign up bonus after minimum spend meet which are as good as it gets. So overall its a win-win situation for both referrer and referee!! To check if you are eligible to refer others use below link and get rolling:

If you are eligible you could potentially earn 20,000 Ultimate Rewards Points per referral which are valued at least $250 based on the "pay yourself back" feature but might provide much higher value for specific travel redemptions. So go ahead and get referring!! Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.

0 Comments

Chase Sapphire Credit Card is the baseline credit card you will need to transfer your Chase Flexible points a.k.a "Chase Ultimate Rewards Points" to various airlines and hotels partners of Chase Ultimate Rewards program (Apart from there Ink Preferred card). The good news is Chase has increased the sign up offer for their "Chase Sapphire Preferred Card" which has $95 annual fee to 80,000 points after $4,000 spend in 3 months after sign up. In addition it is throwing in additional $50 for grocery purchase reimbursement in your first year of the card. The best part of the offer is Chase has "Chase Pay Yourself back" feature where with Sapphire Preferred card you can redeem the points in select rotating category at 1:1.25 ratio. So, 80,000 points can technically be redeemed for $1,000 in those select categories as well if you are not looking to transfer to any travel partners (Airlines or Hotels). Currently you can redeem those points in "Groceries" as an eligible category till Sept 30th, 2021 which makes this card more compelling. One of the important things to note is that you need to be careful about Chase 5/24 rule. If you have opened 5 or more cards in last 24 months then Chase would not approve you for this card. But, if are under 5 new opened credit cards (excluding certain business cards) then you may be eligible for this offer. Also since Chase Sapphire Preferred is counted as premium card for Chase it would increase the odds of approval if you have good credit score as well as existing banking relationship with Chase.

Also there are additional benefits such as free 12 months of Doordash subscription membership (DashPass) and $60 back on eligible Peloton membership. Overall its a great value for the card in year 1 for sure. Another great thing is if you have Chase Freedom or other Ultimate Rewards earning card you can move points from those card to Sapphire Preferred and get a value of ~1.25 times or transfer to partner airlines and hotels. Since there is no end date currently for this offer, get it while its still there as it does not get better than this!! Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website. Chase Sapphire "Pay Yourself Back" for Easy Cash-out at 1.25c (Preferred) or 1.5c (Reserve)!6/1/2020  Chase Sapphire cards has added an amazing feature called "Pay Yourself Back" effective 05/31/2020 where you can cash out ultimate reward points at value of 1.25 cent/point (Preferred card) or 1.5 cent/point (Reserve card) for your purchases made with the card in certain categories. For starters below categories are valid till 09/30/2020:

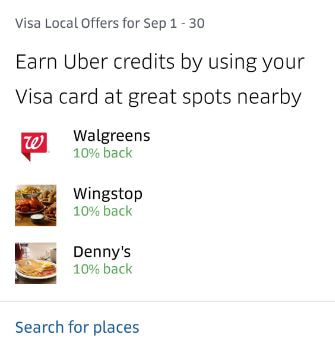

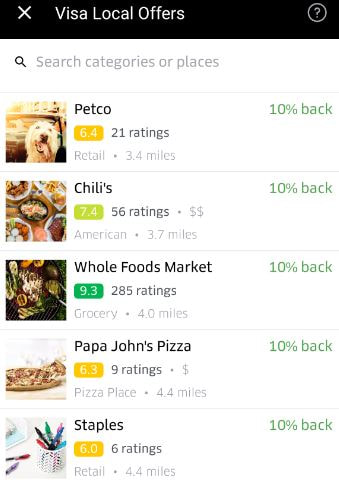

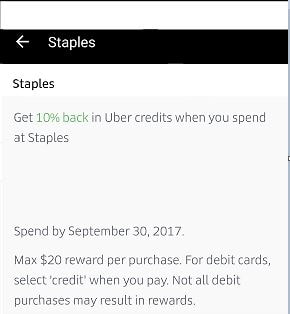

As per the media release the statement credit will post within 3 days after redeeming ultimate rewards for the said charges. You can access the special pay yourself back page here after logging in your chase account and redeeming ultimate reward points for either 1.25 cent/point or 1.5 cent/point value for the said categories depending on which sapphire card you have purchases on. Chase Sapphire Preferred comes with $95 annual fees whereas Chase Sapphire Reserve has annual fees of $550 (although Chase has lowered annual fees to $450 for any renewals from now till December 2020 instead of the regular fees of $550). Also Chase Sapphire Reserve comes with $300 annual travel credit which can now be redeemed against Grocery store purchase or Gas station purchase till Dec 31st, 2020. So, if you have huge stash of Ultimate Reward Points then having one of the Sapphire credit cards would allow you to redeem the points at a great value. You could also upgrade an existing freedom card to Sapphire card. Do remember though that if you go after Sapphire Reserve card you would have to probably pay regular fees of $550 instead of reduce fees of $450 or you could upgrade to Sapphire Preferred for $95 annual fees. So, do your math if it's worth for you to upgrade and to which card!! Hat tip (Doctor Of Credit) Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  Uber has recently launched public program of Visa local offers in select markets where you earn the Uber Credits (Can be used for Uber or Ubereats). You need to have Visa card added to your Uber account and enroll for the program. Once you enroll you will see offers to earn Uber credits at nearby places. The offers are available at various local participating places for any given month and depends on location where you have these participating partners rather than your home address. All you have to do is purchase using the Visa card (use credit card option at checkout) registered on your Uber account at participating partners. While most of these places are restaurants there are quite a few interesting places such as Staples, Walgreens, Whole Foods Market etc. The Uber credit is limited to dollar amount per purchase which varies from $20 to $100 based on the partner but you can make as many purchases in a day with each earning up-to the limit credit. Also note the terms mention that Gift Card purchases are excluded but in reality it is an YMMV and from my experience purchases having combination of Gift cards and regular items and which earn Uber credit within the maximum credit limit works fine. One example of interest is Staples. As you can see from above you can earn Uber credits at Staples store and since you can earn 5x Ultimate Rewards points on all your purchases made with Chase Ink/ Ink plus card at office stores this would give you Uber credits for the purchases you might already be making. As mentioned earlier you can keep the purchases at amount lower that the maximum purchase amount ($200 for Staples as per the offer) on which you earn Uber credits which would hopefully trigger the credits.

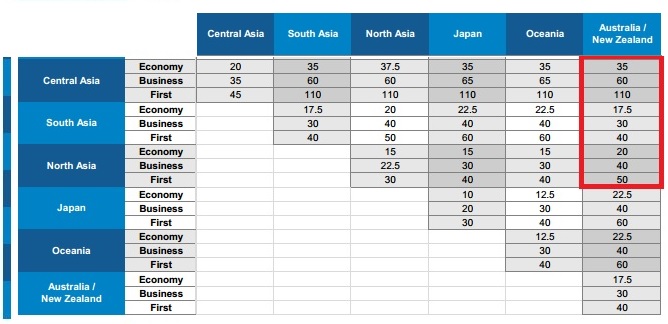

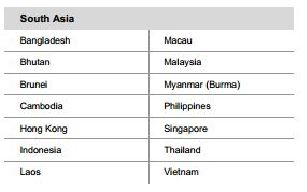

So get the Uber credits using the Visa local offer while it lasts. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website. After the recent devaluation of United Award chart, the awards in premium cabin on partner airlines has gone quite expensive. But the new award chart has a sweet spot created for visiting "Down Under" from quite a few Asian countries that too in premium cabin on partner airlines. To begin with look at the United award chart below: As you can see from the highlighted section above, visiting "Down Under" from South Asia is just 30k miles one way in business or 40k miles in First. You could even do a return trip with a stop-over or 2 open-jaws and still pay 60k/80k in business/first. That is an incredible deal knowing how large is South Asia. Just to get an idea look below on countries classified under "South Asia" by United. The gist is you can get to fly incredible Singapore Airlines, or Thai Airways to visit "Down Under" and go as far as Bangladesh (Dhaka) which is essentially very close to India/Pakistan. Below is the map of what you can do for 80k miles in first class for which US Airways would charge you 120k miles. As you can see from the map you could potentially get a stop-over in either of DAC/BKK/SIN or for that matter any of the United classified "South Asian" country and get to travel "down under" for 80k United miles in First!! Hope this helps folks planning their trip from South Asian countries.

Most often than not on your trip you rent a car and its good to know what all the available options are as well as which websites would fetch you the cheapest car rental cost. To start with there are two kind of rentals you could book:

Opaque Booking: When you book the car rental using this kind of service you are typically renting through 3rd party travel agency site. Below are the advantages and disadvantages of this kind of rental: Advantages:

Transparent Booking: This is how typically you would book you car rental using either 3rd party OTA websites or the car rental agency website. The only disadvantage if you might end up paying a higher price then otherwise you would pay using the "Opaque booking", but the advantages are many as listed below: Advantages:

With that being said for "transparent booking", below are some of the websites which you would find useful for finding promotion / discount codes before you would go ahead and make your car rental reservation or could help you in getting the best available price for your next car rental. Promo Codes / Discount Codes Websites:

Car Rental Booking Websites (OTA): Below is the list of websites which generally tend to give good discounted rates for car rentals. Some of them are limited to access for "members only", but if you have access to them it would be really useful. You would want to try at-least 3 of them before concluding the best available price.

Note: None of the above links are referral links or earns me any commission. Thanks for reading!  Lot of cash back websites like Ebates, Ultimate Rewards Mall or various airlines online shopping portal offer great promotion where you can earn anywhere from 2x to 20x miles/points per dollar spent (2% to 20% cashback) on purchase from various online stores. Some of these portals also provide opportunity to earn miles/points or cashback for buying merchant gift cards. Lot of the folks in miles world buy merchant gift cards to earn lucrative miles through these portals as gift cards tend to be most flexible and can be used for any future purchase from those stores. The side-effect of buying gift cards is sometimes you will end up having few dollars left over in the gift card which you have no idea of what to do with. But what if you could redeem those gift cards for cash? Each state has its own rule concerning the gift card expiry as well as rules governing converting them to cash or check. One of the state with more consumer friendly law is California. The law states that under legal guide S-11 (more information can be found here) any store that sells its own branded gift card is required by law to allow customer to cash out the gift card if the value of the gift card is less than $10. What this means is that at any point your gift card balance falls below $10, the merchant is required to provide the provision to en-cash that gift card for its equivalent cash value (either by cash or check). Although the law provides for this provision most of stores associate are not aware of this and would simply refuse to en-cash the gift card even if the dollar value of gift card is less than $10. Since this provision is provided by law, make sure you Insist for the cash back and if need be speak with the supervisor or the store manager who will be more than willing to consider it. This knowledge of cashing out the gift card is a great way of getting rid of gift cards with a value of less than $10. Below are couple of examples to leverage this:

Note: I do get referal bonus if you use Ebates link above to open your Ebates account. I do appreciate your using the link. |

AuthorI love traveling / backpacking. This blog focuses on below 3 aspects of travel: This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

December 2020

Categories

All

|

RSS Feed

RSS Feed