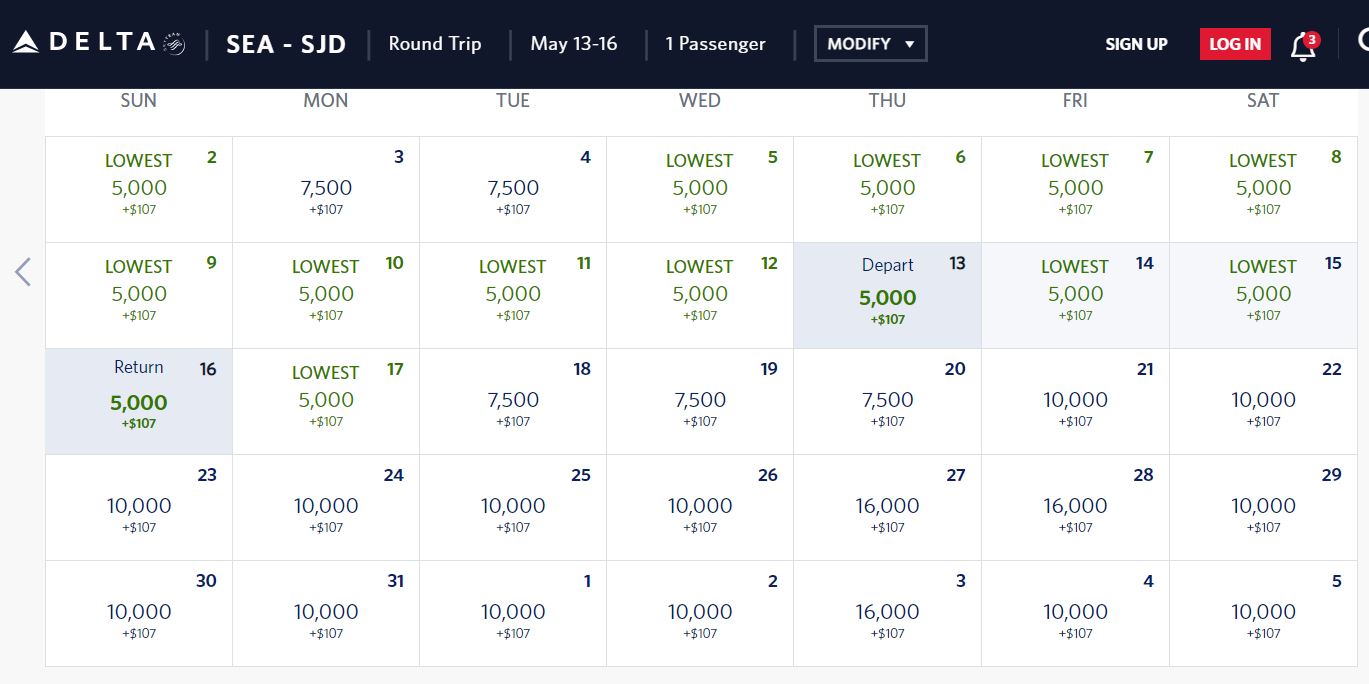

Delta Airlines rescinded their award chart a while ago, but to keep member's interested in their Skymiles award program they kept doing Award Flash Sales to various destinations. When Pandemic hit they stopped doing those flash sales for a while but now it appears that those flash sales have return albeit un-advertised as of now. On the current flash sale you can book round trip tickets starting at 5k miles + taxes/fees for Sunny Mexico destination's from SEA (Seattle) and for little more from other west coast cities such as SFO, LAX. These deals are available all the way to May 2021. So, if you have plans to escape to near by Mexico then you might be interested in checking it out with Delta Skymiles and can search here. Below is a sample search for May 2021. You can similarly search by "Calendar" feature for various destinations to get a monthly view. Also Delta Airlines recently updated their change/cancellation policy for award travel which now gives you more flexibility than before. So, if you are eyeing these destinations it might be a good time to book them on award using Skymiles.

Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.

0 Comments

Hyatt Hotels have been killing with various promotions for earning points as well as reaching the top tier status quickly. If you hold their "World of Hyatt credit card" then you can easily earn 5,000 World of Hyatt points before end of Feb 28th, 2021. You need to register here and then make 50 transactions in total (each of $1 or more) to earn full 5,000 points. If you cannot get there you can still earn tiered points as follows:

Here are the full terms of the promotion: 1 Chase is not responsible for the provision of, or failure to provide, the stated benefits and services. Bonus Points will post directly to your World of Hyatt® account and will not appear on your credit card statement. The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC. 2 See your Card Rewards Program Agreement for more details. WORLD OF HYATT PROGRAM INFORMATION Receipt and use of any World of Hyatt® program points, awards or benefits require membership in the World of Hyatt program. All World of Hyatt points earned through use of the World of Hyatt Credit Card are “Bonus Points” as defined in the World of Hyatt terms and conditions. Bonus Points may be redeemed for awards in the World of Hyatt program, but are not counted for the purposes of calculating a member’s progress toward elite status in the World of Hyatt program. All participation in the World of Hyatt program, including accrual and redemption of Bonus Points, Free Night Awards, Tier Qualifying Night Credits and receipt of membership benefits, is subject to the terms and conditions of the World of Hyatt program. Visit worldofhyatt.com/terms for complete terms and conditions of the World of Hyatt program. Terms and conditions of the World of Hyatt program may be modified, and offers, services and benefits may be added or deleted at any time as described in the World of Hyatt program terms and conditions. World of Hyatt Bonus Points awarded through the use of the authorized user’s card will only be credited to the primary cardmember’s World of Hyatt account. Authorized users will not be eligible for elite status in the World of Hyatt program, or associated benefits, based on their use of the primary cardmember’s World of Hyatt Credit Card. To qualify for this bonus offer, you must register between January 28, 2021 and February 28, 2021 and use your World of Hyatt Credit Card to make a required number of purchases that are each $1.00 or more during the promotional period of February 1, 2021 to February 28, 2021. You will qualify for and receive 1,000 Bonus Points if you make 10 purchases, 1,500 additional Bonus Points if you make 25 total purchases (for a possible total of 2,500 Bonus Points), and 2,500 additional Bonus Points if you make 50 total purchases (for a possible total of 5,000 Bonus Points). Purchases posted to your account with a transaction date during the offer period are eligible for this offer. Delays by the merchant, such as shipping, could extend the transaction date beyond the offer period. Please allow 6 to 8 weeks after the last day of the promotional period for Bonus Points to post to your World of Hyatt account. (“Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers, or similar cash-like transactions, lottery tickets, casino gaming chips, racetrack wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) To qualify for this bonus offer, account must be open and not in default at the time of fulfillment. This promotional offer is nontransferable. So, if you have not yet registered for this promotion, do it now and easily earn 5,000 World of Hyatt points in Feb 2021! Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  Amex Gold Card recently added Uber/UberEats benefit where you get $10 in Uber Cash each month ($120 / year). This benefit was added as an replacement to existing $100 Annual Airline Incidental credit. You will need to add the Amex Gold card to your Uber/UberEats account for the Uber Cash to automatically get loaded for each month. The Amex Gold Card also comes with $10 in dining credit per month at Grubhub/Seamless, Boxed and select few other dining partners. In addition American Express is providing 12 free months of Uber Eats Pass for Amex Green, Gold and Platinum card though you will need to enroll for the same before 12/31/2021. Here are the benefits of having Uber Cash added to your account instead of the Uber dining credit:

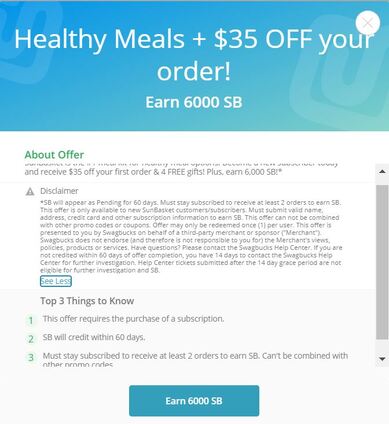

Also American Express is having great sign-up offers available for both Amex Platinum Card (Up to 125k points targeted Offer) and Amex Gold Card (Up to 60k points and 20% [$250 max] in restaurant credit targeted offer) as of now. You can also use this referral link to see if it gives you a better offer [Thanks!]. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  Citi recently introduced "Merchant Offers" on some of their "ThankYou points" earning credit cards. This is probably to compete with likes of "Amex Offers" with American Express and "Chase Offers" on Chase credit cards. While not everyone is targeted with same set of offers and some would not see these even roll out on their cards, it's additional earning or discount available at certain merchants and useful if you any way have plans to make a purchase at that merchant. These offers are usually $back or %back on certain purchase amount such as $10 back on $50 or 10% back on purchase of $100 or more but occasionally you may say really nice offer of $10 back on $20 or $25 back on any purchase of $10 or more at certain merchant!! The cool thing though with Citi is that these offers can stack with the SimplyMiles offers for earning American Airlines miles. This is true for all Citi ThankYou points earning Credit Cards as all of them are Mastercard and thus can be enrolled in American Airlines SimplyMiles program. Also do note that these offers can stack with the "Cashback portal" offers and you can search for any merchant on the aggregator site such as Ca$hback Monitor. Here is an example of stack currently available for Sun Basket.

If you make 2 orders with first order of ~$35 and second order of $65+ you would earn ~$80 + 1k AA miles. The above example is just an illustration how the stack would help to try out a service with some free food and minimal out of pocket cost. As you can see from above offers you can really stack them together to either get something for minimal out of pocket cost or in some cases at great discount!! Do remember though that both Citi Merchant Offers and SimplyMiles offers needs to be activated before usage. So, together stacking can be quite rewarding with these offers.

Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website. U.S. Bank Altitude Reserve Card is not given much attention in miles/points world but it is one of the few premium card's (Annual fee: $400) one should have in the wallet (Caveat: You do need to have U.S. Bank Checking account to get this credit card though!).

Here are the key reason's why you should consider it if you do not have it yet.

Apart from above there are additional features such as Priority Pass (4 free access for card holder + 1 guest per year), Gogo wifi access pass (12 passes per year), $100 credit for Global Entry and other fringe benefits included. But the most important feature of the card is the "Real-Time Rewards" which allows redemption at 1 cent/point for most purchases and at special value of 1.5 cent/point (50% more value of points) when redeemed for travel related purchases such as Airlines, Hotels, Car Rentals and Ride Share. While there is a minimum preset of $250 purchase amount required for car rental and $500 purchase amount required for Lodging, the minimum for other categories such as Airlines, Uber/Lyft starts at $10. So, if you have a purchase made for Airline fare purchase you can double dip by getting reimbursed from your $325 annual credit while also able to redeem your earned points towards this purchase at value of 1.5 cents/point. So, this is in fact a great way cash out the points as well. (Tip: You can book flights with airlines, redeem points with real-time rewards for the charge and later cancel the booking, effectively cashing out your points). For more info on real-time rewards you can check out here. Also U.S. Bank is good about providing retention offer of 5,000 points to 10,000 points if you ask for it when annual fees are due. This can be valued at $75 to $150 respectively and thus make the card sort of fee free ($325 travel credit + $75 in retention credit). So, if you do not have this card yet, now might be a good time to add it to your wallet and have a premium card with almost ~$0 in annual fees. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  American Express like's to "entice" existing customers to upgrade their credit card from "no annual fee" card to the one with "annual fee" after 1 year has passed from the opening of their "no annual fee" card. This is also true for upgrading from lower tier annual fee card to premium annual fee card as Amex can charge higher annual fees. But the real question is "Should you upgrade?". While the general answer will be "It depends"; in reality you can decide that easily based on following few things:

The good news about upgrade offer is there is "NO HARD CREDIT PULL" so you can save that hard pull for another application with good/great sing-up bonus offer. Another good news is the fees for the upgraded card are pro-rated based on the time in Year 2 when you upgrade. So, depending on when you upgrade you might save good amount of annual fees while getting all the benefits of the upgraded card immediately upon upgrade. Also Amex has three tiers of charge card, such as Consumer Amex Green Card, Amex Gold Card and Amex Platinum card, so it's not un-common to get "upgrade offer" for either Amex Gold or Amex Platinum card if all you have is Amex Green Card. And given the current "short term" benefits being added by Amex such as "Paypal credit" on Amex Platinum card or the up-coming Uber credit's on Amex Gold card it might make sense to upgrade based on your upgrade "bonus" offer!! Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  Here we are in "Happy New Year 2021" and thus ready to use/redeem the airline fee credits associated with certain credit card's where the counter reset's at the end of calendar year. Lot of American Express premium credit card's as well as few other cards (Expedia Voyager, BofA Premium Rewards) have their "airline fee credit" counter reset on 01/01. American Express describes these airline fee credits which comes as part of Amex Gold and other premium cards as incidentals for reimbursing fees such as baggage, seat upgrade etc. But based on what gets reimbursed there are certain charges which although not exactly incidentals still work for reimbursement. For American Express you need to select One airline of the Major U.S. Carriers for given calendar year before you make the charge for incidental (which can be done online). There are certain purchases with United Airlines, Delta Airlines and Southwest Airlines which still get reimburse as of this writing, but what works today may not be working today and your best resource is this flyertalk thread for Southwest. Other airlines flyertalk thread can be found on that page! Here are the amounts of airlines incidentals for few of the popular cards per calendar year:

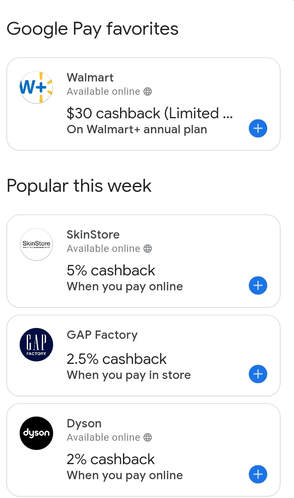

So, get going on these use/re-imbursement's for something other than the actual airline incidentals if you have any of the above card's in your wallet. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  Google Pay has been revamped and if you do not mind sharing your credit/debit card info with Google then it would be a great addition to your phone wallet at least in the short term. The reason being Google Pay is currently offering a great promotion where the referral and referred person both earn $21 when the referred person makes a qualified purchase of $10 or more. (Here is my referral link Thanks!). The good news is that even if you have had used Google Pay in the past, since this is the revamped App, you can still sign up with referral link and earn $21. But this is not the only reason for sign up. Google Pay has also integrated card linked cash back offers as part of the revamped App and currently it is offering great deal's such as $21 on purchase of $50+ at Target, 20% back for purchase at REI with up to $50 back in cash back and $30 back on Walmart+ sign up. These offers need to be activated/added and the terms vary from offer to offer and there are separate offers for In-store or online purchase. The Google Pay app still retains the useful feature of person-to-person pay as well as group pay feature which allows for Venmo like split payment feature. It also has host of other features like spend tracking etc which folks may or may not be comfortable on sharing with Google. Since Google explicitly asks you for enabling personalized offer, you can turn it down and still use it as a short term opportunity for earning some $$ or cash back.

The good news is that you can unlink the cards, account and thus be done with it if you are not a fan of "Google Pay" in long term. For short term though this is a good opportunity to earn quick $21 referred credit without leaving your home. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  Lot of credit cards with useful perks come with annual fees. The perks may range from benign such as "No foreign transaction fee" to high end perk such as free hotel night/certificate, travel credit for airlines or shopping/dining credits. While No-annual fee credit cards might be preferred, there can be great benefits with annual fee card which might justify paying the annual fee's and could be easily recouped based on your usage of the perk/benefit. Still, one of most overlooked thing about annual fee card's is the ability to ask for retention offers which can either completely or partially offset the annual fees. While not all annual fee card provider would provide retention offer, it is still worth few minutes of your time to call and check. Also getting retention offer will vary from card to card and from person to person. So, how do you go about getting one? You can try below two options: Send a secure message or do online chat: The easiest way to get your message across is by sending a secure message (Chase?) if it is an option or doing online chat (American Express?) and sending it after the annual fee has posted is the best time. Be specific in your query and ask for any statement credit or points benefit you can get to offset your annual fees. Talk to the Customer Care and ask for specialist or supervisor: The best time to ask for a retention offer is when your annual fees posts to your credit card account. Call the number on the back of the card and talk with the agent and explain him about the annual fees. You will hear the standard description from the agent about the perks of the card and why you should be paying the annual fees. Your best defense is NOT to ask for "Fee Waiver" but rather for "statement credit" or for points/miles earning card any offer which would provide "X number of points/miles". If the talk does not go anywhere ask for specialist or supervisor as they have more lee-way and see offers which the front line customer care agent may not see. Do NOT say that you want to cancel the card but rather you are considering cancellation as that makes your intent known at the same time gauging if the agent has anything to offer. Which Credit Card Issuer are easy to budge? Most of the credit card issuer will look at your relationship and the length of time you are a customer before providing any retention offer, but this is a big YMMV. There are certain credit card issuer such as American Express who are known to provide points offer or statement credit for their own portfolio of cards and less inclined to provide it for the co-branded credit cards. While other such as Chase Bank are not known for providing offers on co-branded credit cards. Yet, banks such as U.S. Bank are known to routinely issue 5k to 10k bonus points annually on their high end Altitude Reserve Visa Infinite Card "If you ask". So, there is no golden rule out there, but the key is "To Ask!". So, if you have your annual fee coming up do not hesitate to ask even though you might not be looking to cancel the card as you might be pleasantly surprised with the Retention Offer! Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website.  COVID-19 has disrupted many travel plans and a side effect of struggling airline industry is the airlines credit or discount codes issued in lieu of direct refund wherever the airlines could offer it. But due to on and off lock downs and travel restrictions even folks who were issued those airline credit or discount code would find difficult in using it. So, if you have expiring airlines credits or discount codes here are few things you can do: Contact airline's to see if they can courtesy extend your credit: Lot of airlines realize that it still might not be possible for folks to use the credit or discount code's and given the ramping COVID-19 they might be willing to extend it or re-issue a new code with future expiration date. Convert the credits to airlines miles (YMMV, but keep an eye for any special run by airlines): Few airlines have been innovative and have provided members with option to convert their available credits due to cancellation to airline miles. Southwest Airlines already have active promotion for the same (So check if your credit qualifies) and Alaska Air has run the promotion couple of times in the past, so keep any eye if you have Alaska Airlines credit. Use the credit or discount code to book future trip: While your credit may expire it generally can be used for booking future flights before expiration. Although how far in future you can book depends on airlines, usually you should be able to book 330 days out on major U.S. airlines (Except Southwest Airlines). So as a last resort you can book something way out with hope of taking that flight and hoping if there are schedule changes you can use it to your advantage to change your ticket for free without any additional cost. So, do not sit and let that airline credit/ discount code expire but rather act upon it with whichever options works out for you before the expiration date. Disclaimer: Some of the links used in the post may be referral links and earn referral to this site. We appreciate you supporting the website. |

AuthorI love traveling / backpacking. This blog focuses on below 3 aspects of travel: This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

December 2020

Categories

All

|

RSS Feed

RSS Feed